DocuSign (NASDAQ:DOCU) continues to benefit from the digital transformation underway in the business world, but the stock got to an extreme valuation heading into the FQ1'21 results. My bullish view on the stock ended prior to earnings on the run-up to the highs above $150. The stock had already doubled since my March article. The COVID-19 cloud stocks aren't priced for much upside heading into the summer months.

Big Beats Will Slow Down

For FQ1, the electronic document company saw revenues jump 39% to $297.0 million and above the estimates for only $281.1 million. The company had previously guided to $282.0 million for the quarter ending April 30, so clearly analysts weren't aggressive enough in hiking estimates despite the obviously bullish environment.

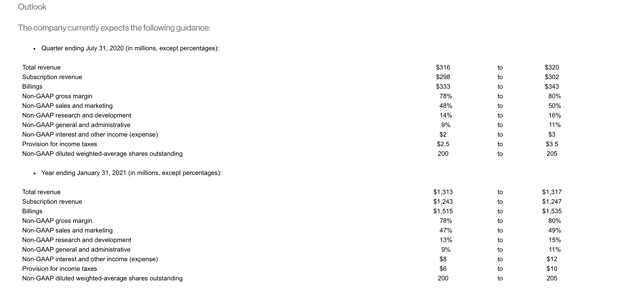

The real question is the sustainability of these results as the virus fears dissipate and most of the economy reopens. The company guided to FQ2 bookings of $338 million and FY21 bookings of $1,525 million.

Source: DocuSign FQ1'21 earnings release

The FQ2 number is down from the $342 million reported in FQ1, while the bookings for the year are up ~$85 million from the guidance given along with FQ4'20 numbers.

Considering DocuSign beat original FQ1 bookings guidance of $284 million by $56 million, the updated guidance for the year tells the expected cooling-off story. A cooling-off period isn't the worst thing for the company still growing bookings for the year in the 40% range.

The company remains an impressive financial force in the digital transformation space. DocuSign generated operating cash flows of $59.1 million and free cash flows of $32.8 million in the quarter.

With 80% gross margins and SG&A expenses below 70%, DocuSign already has an impressive profit stream here, with revenue just topping the $1 billion annual level. The company is a clear long-term growth story likely to be highly profitable.

Looking for a portfolio of ideas like this one? Members of DIY Value Investing get exclusive access to our model portfolios plus so much more. Signup today to see the stocks bought by my Out Fox model during this market crash.

Looking for a portfolio of ideas like this one? Members of DIY Value Investing get exclusive access to our model portfolios plus so much more. Signup today to see the stocks bought by my Out Fox model during this market crash.