In my last article titled “ACADIA: The company perspectives in numbers”, I described the demographic trends that the company is operating under, listed key near-term catalysts, and made an overview of the company’s development. However, in the comments to the article, I noticed investor interest in the company’s valuations and price target. Thus, I decided to perform a valuation of the company’s existing segment for PDP treatment with its marketed medication NUPLAZID, as well as take a look at the 10-year horizon for the company segment under different assumptions and 3 scenarios.

In this analysis I will use 4 assumptions:

Assumption 1: Pimavanserin prescriptions.

I am assuming that patients struggling with PDP who are prescribed the company’s medication (NUPLAZID) will take it once daily at 34 mg/day for the period of a year, which is the average treatment period for clinical trials of this nature.

Assumption 2: Price.

The price for a 34mg capsule is $78/daily, which translates into $2,380/monthly and $28,080 annually. I will not make any assumptions about potential price changes in the medication in the future and will avoid discussing drug market inflation and government price regulations.

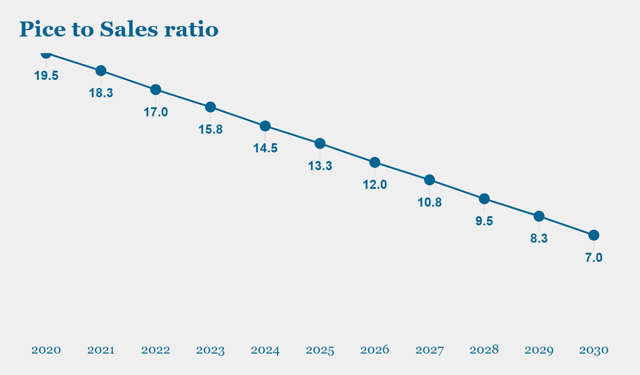

Assumption 3: Price to Sales ratio.

The general assumptions are for the P/S ratio to stand at the current value of 19.5x in 2020 and gradually move towards the current industry average of 7x by 2030. This implies that, by 2030, the company will have reached its growth stage potential and will have moved to a mature growth stage with average industry valuations and growth pace.

Assumption 4: Number of PDP Patients.

I will be using data from my previous article which states that 470K patients were struggling with PDP in 2019 and this number is expected to reach 720K by 2030. In the current article, I will be using the total