Investors have three main options when investing in REITs:

- (1) They can invest in an exchange-traded fund.

- (2) They can invest in a closed-end fund.

- (3) Or they can invest in individual REITs and build their own portfolio.

A growing number of investors pick the second option. CEFs allow you to gain passive and diversified exposure to the REIT sector with the added benefits of active management which could lead to higher total returns.

The idea is great in that a CEF can combine the best of passive and active investing by allowing you to earn the superior returns of active investing without having to lift a finger. It's a good pitch that attracts a lot of investors.

In reality, the results have been very disappointing, even for the highest-quality REIT CEFs. Cohen & Steers Quality Income Realty Fund (RQI) is commonly recognized as the gold standard of REIT CEFs. Yet, it has historically delivered lower returns with higher risk than passive REIT ETFs.

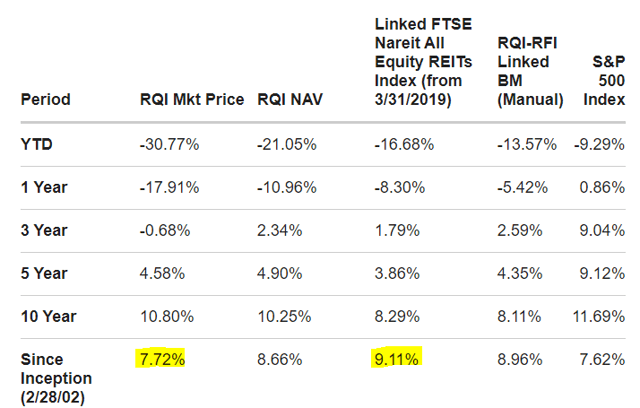

RQI returned 7.7% per year compared to 9.1% per year for a passive REIT benchmark since inception. Even more disappointing is that RQI achieved these inferior results despite taking higher risks:

Below we explain three reasons why RQI failed investors and why we are not buying it:

Reason #1: Excessive Leverage

A lot of individual investors get seduced by RQI and other CEFs because they pay much higher dividends than ETFs.

However, it's important to understand how they achieve this higher yield. The “secret” here is leverage. RQI has a 25% leverage ratio. This leverage comes on top of the leverage that REITs use themselves. It essentially adds a second layer of leverage.

And if there's anything to learned from past bear markets, it's that overleverage mixes very poorly with REIT investments. RQI dropped as much

With Better Information, You Get Better Results…

At High Yield Landlord, We spend 1000s of hours and well over $50,000 per year researching the REIT, MLP and other real estate markets for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

At High Yield Landlord, We spend 1000s of hours and well over $50,000 per year researching the REIT, MLP and other real estate markets for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

- We are the #1 rated service on Seeking Alpha with a perfect 5/5 rating.

- We are the #1 ranked service for Real Estate Investors with 1600 members.