Overview

We believe that Cerence (NASDAQ:CRNC), the market-leading provider of automotive AI technology, will continue benefiting from the secular growth of automotive AI-based virtual assistants and maintain its leading position for the foreseeable future. Despite being founded in 2019 as a result of a spin-off from Nuance (NUAN), the conversational AI company we have also rated highly, Cerence has spent over 20 years in the automotive industry as a combined entity, perfecting its technology solutions and developing relationships with the major automakers. At present, we see two medium-term key catalysts in the business as we initiate our coverage with an Overweight rating.

Catalyst

Cerence will continue to benefit from the secular growth of automotive AI-based virtual assistants. We believe that AI-based virtual assistant technology will become a mainstream offering in the next decade. Consequently, having traditionally focused on onboarding Tier 1 OEMs, we expect Cerence to expand its TAM to include the lower-tier OEMs in the future.

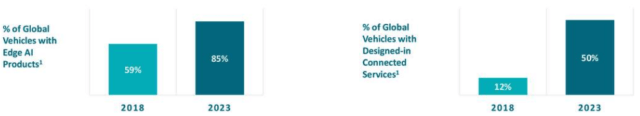

(Source: Company’s Earnings Call Slide)

The expansion should allow the company to secure the 85% target market share for its Edge AI and 50% for the cloud-based connected technology solution. In Q2 2020, we have also seen the landing of China-based medium-tier Geely Auto (OTCPK:GELYF) and Great Wall Motors (OTCPK:GWLLF) (through its strategic partner Bean Tech) as clients, as a sign of increasing penetration into the lower-tier market. Moreover, the company’s strong 23% revenue growth in Q2 2020 despite the decline in global auto sales also demonstrates the secular tailwind for the business.

We expect Cerence to continue to gain market shares and maintain its leadership. At present, over 325 million vehicles globally are using Cerence technology. Furthermore, over 60 automotive brands worldwide are customers, while the AI solution has also covered over 70 languages and dialects. The figures are not surprising given the 20 years' worth of business