Written by Nick Ackerman, co-produced by Stanford Chemist

Gabelli Dividend & Income Trust (NYSE:GDV) is a closed-end fund that has offered attractive returns over the longer term. However, on a YTD basis and over the last couple of years, the fund has really struggled. This has been on both a share price basis and a NAV basis. The underperformance relative to the SPDR S&P 500 (SPY) really started in 2018. This then continued in 2019 with SPY's total NAV return of a whopping 31.29%. GDV was able to have a total NAV return of 24.54%, which is typically quite respectable but comparatively speaking is rather disappointing.

A reason for this underperformance is the fund's tilt towards holding a higher allocation to the financial sector. I've covered several pieces lately talking about the financial space; one on BlackRock's Enhanced Equity Dividend Trust (BDJ) and another on John Hancock's Financial Opportunity Fund (BTO) - a fund with a primary focus on the financial space.

GDV also conducted a rights offering last year, in November. That saw the fund offer new shares that slightly diluted shareholders. In all, this didn't move the needle for the fund in a massive way since there was a floor put in place. In fact, the offering was oversubscribed and exceeded the amount available. I would say that it was quite a successful raising of capital for the managers.

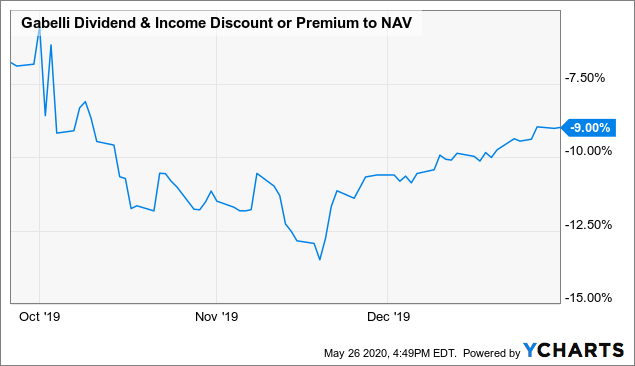

In fact, we saw from when the fund announced its rights offering on September 23rd to the end of 2019 - the discount hadn't really ticked all that much wider before closing that gap again.

Since then, the fund's discount has begun to widen again back to slightly over 11% to the current 11.09%. I believe that this fund might be attractive to pick up at these current levels due to this

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!