Introduction

The recent global economic turmoil from the coronavirus has further suppressed interest rates, whilst simultaneously making it very difficult for investors to still find a high yield that has not been reduced. One such rare example is the near 14% yielding KNOT Offshore Partners (NYSE:KNOP), who operates in a niche market shuttling oil from offshore installations to onshore facilities, which has held up surprisingly well during this recent turmoil.

Distribution Coverage

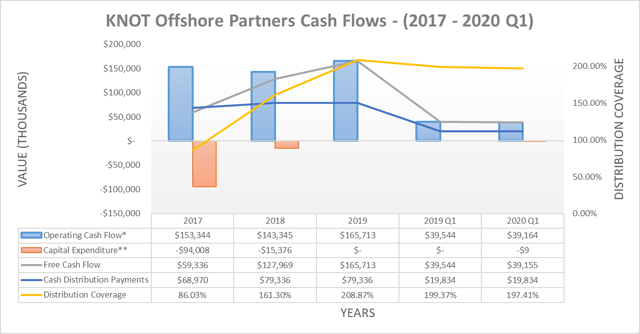

When assessing distribution coverage, I prefer to forgo using earnings per share and use free cash flow instead, since distributions are paid from cash and not from “earnings”. The graph included below summarizes their cash flows from the last quarter and the previous three years.

Image Source: Author.

Since their capital expenditure is very lumpy, as it comprises their acquisition of vessels, it is particularly important to assess their distribution coverage across a number of years, which has averaged a solid 152.07% during 2017-2019. This importantly indicates that they can fund their distribution payments without the use of debt, which is very attractive and rare for an entity with a double-digit distribution yield.

When looking towards the future there seem to be reasons to believe that this should continue indefinitely, barring any black-swan events. They operate under charter contracts that are time not volume-based and span across the medium to long-term with highly rated major oil and gas companies, as per slide eight of their first quarter of 2020 results presentation.

After combining these already desirable aspects with the characteristics of the oil industry, it creates a desirable situation whereby they should be able to outlast this downturn. Generally speaking, offshore oil production is less likely to be shut-in than shale oil production due to an oversupply, which means that they should see better and continued demand for their services than many other niches markets. If oil prices fail to ever recover to at least their 2017-2019 levels and as a result, offshore oil production is eventually shut-in, then it likely stems from a large scale global economic collapse and thus investors will likely have more pressing issues on their mind.

Financial Position

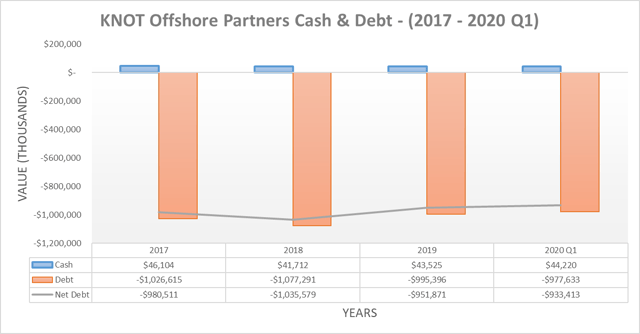

Since their free cash flow has been adequate to cover their distribution payments, their financial position will play an instrumental role in determining the attractiveness of their massive distribution yield. The three graphs included below summarize their financial position from the last quarter and the previous three years.

Image Source: Author.

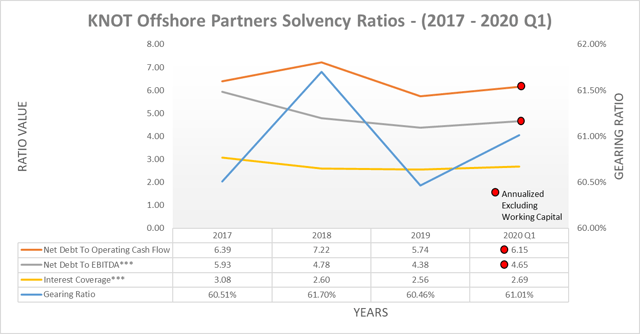

After reviewing these financial metrics their first main drawback becomes apparent, they have moderately high leverage with a net debt-to-EBITDA of 4.65 and interest coverage of 2.69. Whilst these are certainly not ideal, thankfully they are not at a crisis level given their fairly steady and resilient earnings, but it nonetheless leaves them little room for error. Even a modest and temporary decline could force them to reduce their distribution, however, considering their current distribution yield is around 14%, this is arguably already priced into their units.

Thankfully since they produce free cash flow after distribution payments on average, they should be capable of continuing to deleverage across the coming years, albeit at a slow pace. During 2017-2019 this only averaged $42m and thus it would take them quite a length of time to make any material dent in their net debt, taking seven years just to reduce it by one-third.

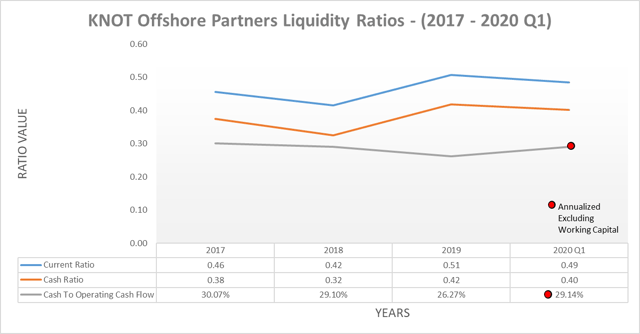

Image Source: Author.

The second main drawback comes from their lower than desired liquidity and to a slightly lesser extent, their short-dated debt maturity profile. Their rather low liquidity is easily apparent with their current ratio of only 0.49, however, thankfully most of their current assets are comprised of cash and thus their cash ratio is quite decent at 0.40, which partly mitigates the risks. Whilst they still retain a further $28.7m undrawn from their credit facilities, if required this would not provide significant medium-term assistance given it is not even the equivalent of one quarter of operating cash flow. If it were not for their resilient earnings and history of producing free cash flow, this would be concerning but in this situation, it seems adequate, although similar to their high leverage, it leaves them little room for error.

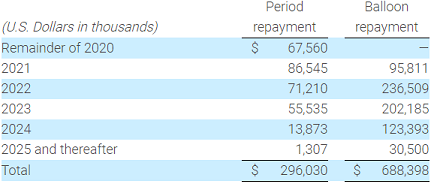

Even though their short-dated debt maturity profile is less than ideal, as seen in the table included below, seeing as they are fundamentally viable through generating free cash flow and have resilient earnings, it should not cause any problems. It seems most likely that they should be capable of refinancing any future debt maturities as required, especially given the likely continued monetary policy support from central banks. Although given they are a fairly small organization with a market capitalization of less than $1b, the risk profile is nonetheless higher than for major oil and gas companies.

Image Source: KNOT Offshore Partners First Quarter Of 2020 Report.

Conclusion

Finding an organization with a high double-digit yield that is covered with what should remain resilient free cash flow is exceedingly rare. Unfortunately, their high leverage and lower than desired liquidity means that they have little room for errors. Although with such a high distribution yield, even if they are forced to halve their distributions to expedite deleveraging, then they would still offer a solid distribution yield around 7%. Given this balance of risk to reward, I believe that a bullish rating is appropriate, however, their leverage keeps risks elevated, and thus I also feel that investors would be well suited to keep any investment relatively small.

Notes: Unless specified otherwise, all figures in this article were taken from KNOT Offshore Partners’ Quarterly Reports, all calculated figures were performed by the author.