The share prices of U.S. ethanol producers Aemetis (AMTX), The Andersons (ANDE), Green Plains, Inc. (GPRE), Pacific Ethanol (PEIX), and REX American Resources (REX) have largely recovered from the coronavirus-induced swoons that they underwent in March and April (see figure). One producer, Pacific Ethanol, has even recorded a sizable gain over the period, although its share price had been battered by the company's poor financial position well before the pandemic severely disrupted U.S. ethanol demand.

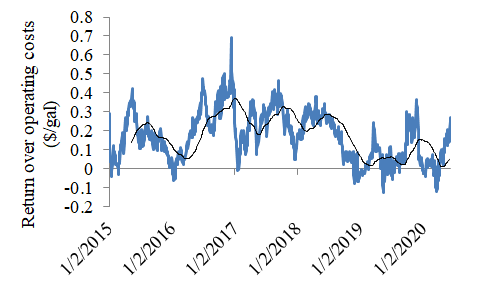

The sector's recovery has been driven by a strong rebound in ethanol production margins that has occurred since late April (see figure). This rebound has in turn been the result of a 34% gain by the price of ethanol from April's lows compared to 7% increases by the prices of corn and natural gas, two important inputs, over the same period. Production margins as measured by Iowa State University's Center for Agricultural and Rural Development set a multi-year low in April but have since moved back into positive territory, most recently pushing above the capital cost threshold (not that the construction of new capacity is likely).

Returns at a hypothetical Iowa dry mill ethanol production facility. Sources: CARD, EIA (2020).

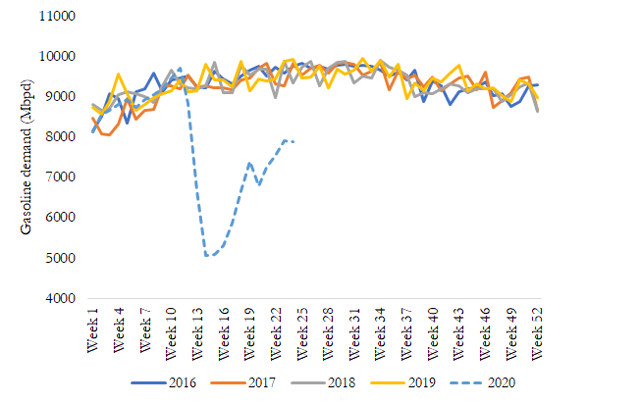

Two factors have had an outsized impact on the ethanol sector's improvement. The first has been the partial recovery of U.S. gasoline demand. While the fuel's consumption remains approximately 20% lower than is normally seen in June (see figure), it has increased by 50% from April's lows. Ethanol demand is closely tied to gasoline demand since almost all of the former is blended with the latter prior to retail, and the collapse of gasoline demand that occurred earlier this year was the primary cause of the ethanol sector's poor production margins. Improved gasoline demand has therefore translated to higher ethanol demand.

Source: EIA (2020).

That