One of the most popular articles I’ve written so far during the pandemic is “Now Playing: The Movie Theater Apocalypse.” In it, I noted how:

“This area of experiential retail is one of the hardest hit of all of the industries that we follow…

“We recently published a cautionary article related to EPR Properties (NYSE:EPR), which has roughly 54% exposure to theaters. This is a prime example of a company that will be impacted by the performance of this industry.”

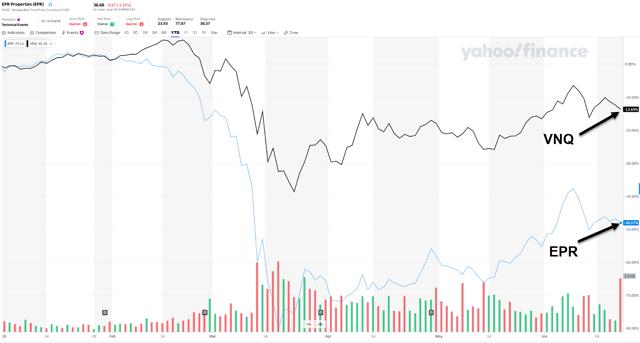

Source: Yahoo Finance

To be fair, EPR shares have modestly recovered during the last 60 days. But they still lag most equity REITs, as illustrated above.

In short, the stock fell much harder at the beginning of the pandemic. As such, it remains around 48% below what it was a year ago.

Compare that to -12.4% for Vanguard Real Estate Index Fund ETF Shares (VNQ).

So does that make it a bargain buy?

To answer that, we should probably start out by looking at the newest information out about it.

One Way to Keep Talking to a Minimum During a Movie

When many movie theaters first began officially talking about reopening, they did so under a “masks maybe optional” understanding.

On Friday, however, that changed with the big dogs, with both Regal Cinemas and AMC (AMC) reversing course completely.

Here’s what AMC’s CEO and President Adam Aron had to say:

“At AMC, we have been consulting with top scientists and health experts to create a broad, sweeping, far-reaching health and safety effort to make AMC Theatres safe for our guests and associates when our theatres reopen in July.”

Their conclusion was for all employees to wear masks, as well as guests in locations that required such accessories.

“In those areas of the country where masks will not be required, we

Become Part of Wide Moat Research

iREIT on Alpha and The Dividend Kings are two of the fastest-growing marketplace services with a team of eight of the most experienced equity analysts. We offer unparalleled services including five customized portfolios that are doing extremely well in the moment - but are built to stand the test of time too.