Atomera (NASDAQ:ATOM) is the owner of the proprietary MST (Mears Silicon Technology), which is a thin film of re-engineered silicon that functions as a transistor channel enhancement to CMOS transistors.

The company still doesn't generate much revenue, as the price emerges when customers move to adopt the MST technology in their own production facilities and generate royalties. With even one fab the company would already become profitable, and we think the chances of this happening are increasing all the time. But so is the company's market capitalization.

We have called the shares of Atomera a high-risk, high-reward play for investors, and so it is playing out. The last time we reported on the company was in February before the pandemic broke out in earnest. The surprising thing is that since then, the shares have more than doubled.

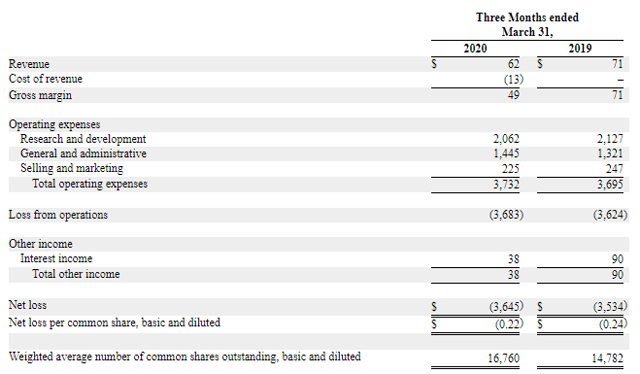

This suggests something is going right for the company. It isn't revenue generation, as the company still generates very little, and it produces heavy losses:

So what accounts for the investor enthusiasm? First, the bad news:

- Revenue

- Cash

The company still has a tiny revenue. From the 10-Q:

What's more, they expect to have no revenue whatsoever in Q2, not that it makes that much difference.

Cash

The company burns about $10M of cash a year:

After the close of Q1, the company had $11.4M (down $3.5M from the end of 2019). Although there was no immediate necessity (indeed, management said during the Q1CC that they did not have "near-term" plans to raise capital), the company issued new shares in a May 15 financing, consisting of (PR):

2,024,000 shares of common stock at a public offering price of $5.00 per share. The total offering included 264,000 shares sold as a result of the underwriter’s exercise of its overallotment option in full.

So