In today's market, it is easy to overlook a stock like ADMA Biologics (NASDAQ:ADMA), which has barely moved even as the market has continued to shoot up. However, despite its boring appearance, ADMA actually has a really compelling "high probability" bull case that should play out over the next 1-2 years and provide substantial alpha to investors. If you're a patient investor, it isn't a bad idea to pick up some shares now and wait for the thesis to play out.

Source: google images

About ADMA

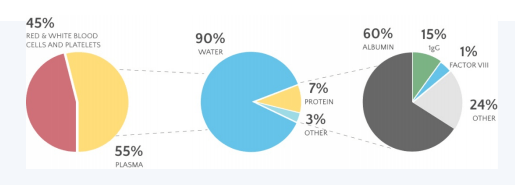

ADMA mainly collects and processes plasma into higher-value products. Plasma is a yellowish liquid that makes up around 55% of a body's total blood volume. While it is mainly composed of water, it also contains important compounds like immunoglobulins that can be used to create a variety of therapeutic products.

ADMA has 3 FDA approved plasma-derived products. BIVIGAM and Asceniv, both approved in 2019, are intravenous immunoglobulin products used to combat primary immunodeficiency. Nabi HB is a much older product that is used to treat Hepatitis B.

Immunoglobulin market

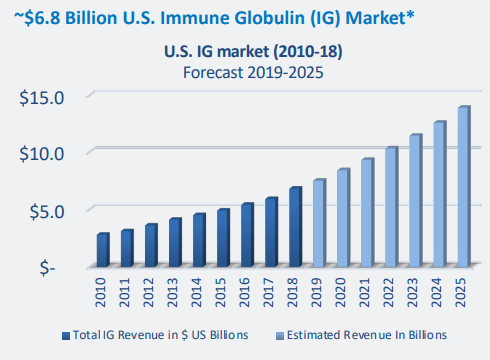

Historically, the US immunoglobulin, or IG, market has seen slow and steady high single-digit/low double-digit growth over the past few years and is expected to keep up the growth over the next few years, growing from $6.8bil in 2018 to $13.9bil in 2025.

Source: investor presentation

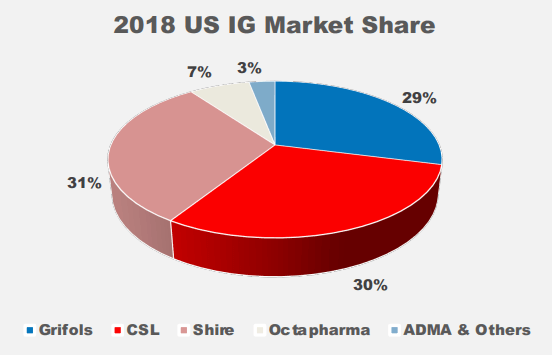

It is a very concentrated market due to the regulatory high barriers to entry. Currently, there are just 6 companies approved to produce IGs, with CSL and Grifols (GRFS) holding the largest chunk of share. Usually, it takes 7-12 months between producing and releasing a batch of IG products.

Source: investor presentation

Due to the short shelf life and high barriers to entry to the IG market, it can be hard for companies to respond to market