Article Thesis

On the weekend, Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) announced that they would acquire several natural gas assets from Dominion Energy (D) in a deal valued at $10 billion. Looking at the price of the deal and the assets Berkshire will get, it looks like Buffett's Berkshire is the winner in this deal, being able to acquire assets at a quite low valuation. Dominion Energy, on the other hand, does not seem to be much of a winner in this deal.

The deal also has implications for other natural gas assets and their owners, as they now got the "stamp of approval" from Buffett himself.

Source: Imgflip.com

Source: Imgflip.com

The Deal For Dominion's Assets

The deal was first announced on Sunday and values the assets at $9.7 billion. About $4 billion of that will be paid in cash, while Berkshire Hathaway will also assume $5.7 billion in associated debt. Net proceeds for Dominion Energy will be lower than $4 billion, however, as the company will have to pay taxes on the amount it receives, which is why net proceeds for Dominion are seen at just around $3 billion. Dominion Energy still gets rid of close to $6 billion in debt on top of the cash proceeds it will receive, which will help clean up its balance sheet to some degree.

The assets that Berkshire Hathaway will acquire consist of close to 8,000 miles of natural gas transmission pipelines, and 900 billion cubic feet of natural gas storage capacity. Dominion Energy will sell most of its natural gas-related assets in this deal. Both companies expect that the deal will close during the fourth quarter of 2020.

Why Berkshire Is Buying Natural Gas Assets Now

Buffett himself has oftentimes stated that buying when valuations are low is a key factor for outperformance, highly publicized quotes

Is This an Income Stream Which Induces Fear?

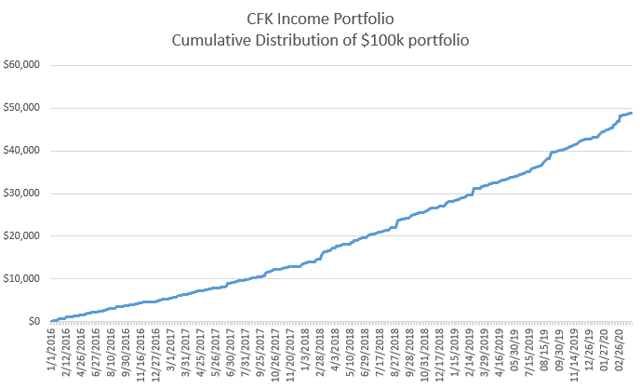

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% - 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio's price can fluctuate, the income stream not so much. Start your free two-week trial today!