A variety of markets and business models have been tested through the current crisis. One such model that has been tested is the residential mortgage market, which has seen an enormous surge in refinance activity due to historically low rates, as well as higher forbearance activity given tens of millions of job losses in the US.

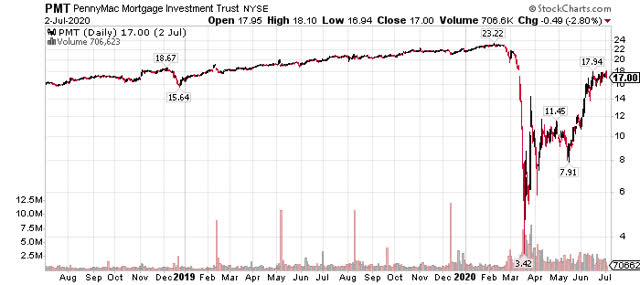

PennyMac Mortgage Investment Trust (NYSE:PMT) saw its share price fall from $23 before the crash to a low of just $3.42 in March. That sort of value destruction can make shareholders' collective head spin, but PennyMac has rallied hard in the time since, trading for $17 as of this writing. While much of the prior losses have been recovered, I think the balance of risk is now in favor of the bears rather than the bulls. PennyMac's business is far from unscathed from the changes in the mortgage market, and at the current tangible book value multiple, it looks fairly priced at best.

A three-pronged approach

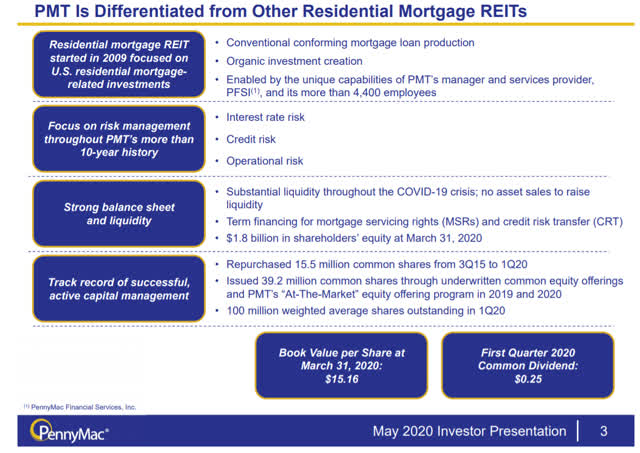

PennyMac is a REIT that invests in mortgage assets in the US. It operates as a specialty finance company, but is structured as a REIT for tax purposes. It also means the trust distributes substantially all of its income as dividends to shareholders.

Source: Investor presentation

The trust focuses on conforming residential mortgage loan production and has the support of its parent company, PennyMac Financial Services (PFSI), which is the trust's manager and servicer. Importantly, PennyMac has ample liquidity to weather the current crisis, and substantial book value of $15.16 per share as of the end of the quarter.

Source: Investor presentation

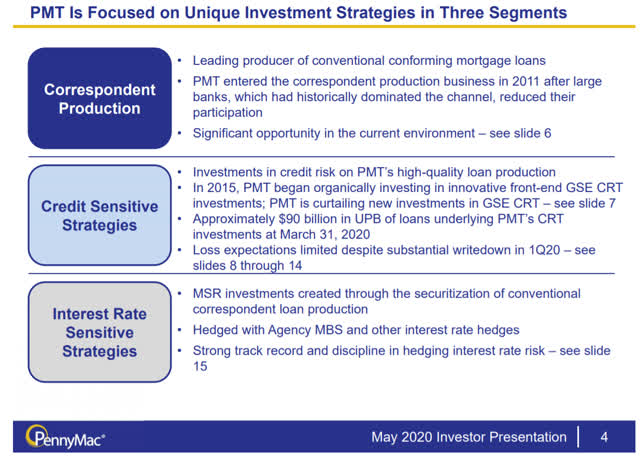

PennyMac is focused on three different ways to generate returns in the mortgage market. The most significant one is correspondent production, which focuses on conforming residential mortgage loan production in the US.

After the financial crisis, the largest US banks reduced exposure to mortgage lending as a way to de-risk and meet new capital obligations. This opened the door for non-bank entities to enter the market, such as PennyMac, and it has built significant exposure in the interim.

The second is credit-sensitive strategies, which invest in credit risk on the trust's loan production. This is a relatively new segment as PennyMac entered the business in 2015. The trust has had significant scale in this segment, but is slowly reducing exposure in this business.

Source: Investor presentation

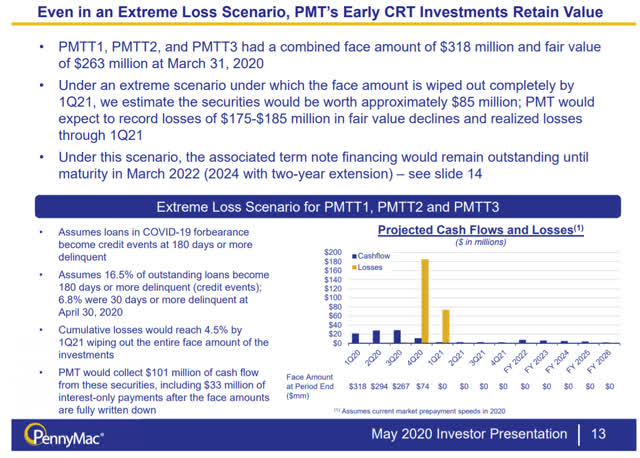

CRT has sizable loss projections, as seen above, as these instruments haven't been performing particularly well in the current climate. We can see above that projected losses would be sizable under an extreme loss scenario, but reality will likely be something less. Still, PennyMac is reducing exposure to this line of business given the Federal Housing Authority has instructed Fannie and Freddie to gradually wind down front-end lender risk share transactions by the end of 2020. What that means in plain English is that PennyMac is curtailing new investments in this space, so it will lose relevance over time when talking about the consolidated business.

Source: Investor presentation

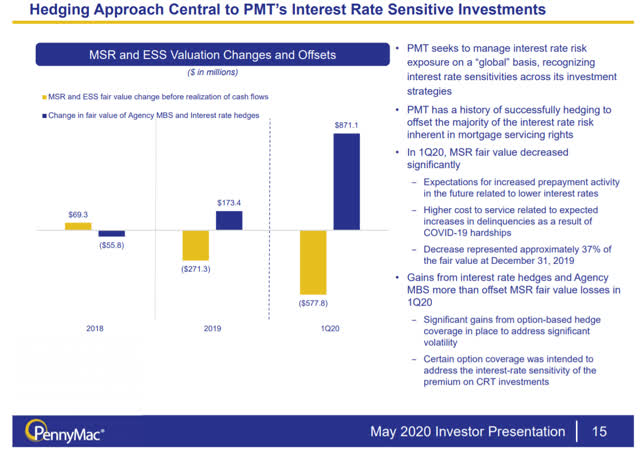

The final segment is interest-rate-sensitive strategies, which are essentially hedged investments in securitizations. We can see above that this segment has spotty success in terms of hedging away risk from fair value changes in its investments, with Q1 of this year being an outlier to the upside. This business is a bit of a wildcard, but its hedging strategy produced a huge gain in Q1 after a much smaller loss in 2019. It will be interesting to see how this segment of the business performs in Q2 given the enormous movement in interest rates and asset prices in Q2. Depending upon how actively the trust managed its hedges, we could see at least a partial reversal of Q1 gains.

Growth is possible, but it looks priced in

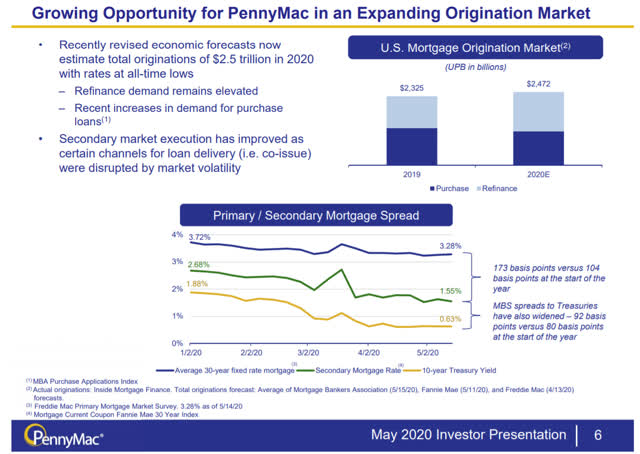

To be fair, PennyMac has a very long growth runway in what is a positively huge market.

Source: Investor presentation

Refinances have been soaring in recent months as consumers look to take advantage of historically low rates. This is great in a way for PennyMac and its competitors, and as we can see, mortgage originations are expected to be meaningfully higher this year than last, despite the enormous disruption from COVID-19 shutdowns. Conditions seem to have normalized in terms of liquidity, so the outlook is much better than it was three or four months ago.

Source: Investor presentation

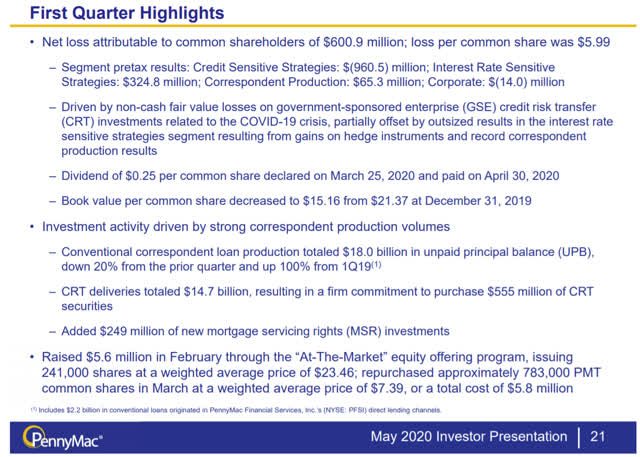

The trust's CRT investments caused a huge non-cash loss in Q1, but the trust felt good enough about earnings to pay a $0.25 per share dividend. Book value declined significantly, falling from $21.37 to $15.16 in the space of three months. What the balance sheet looked like at the end of Q2 remains to be seen.

Part of my concern with PennyMac is that the model it has used with success in the past may not really be intact in the way that it was.

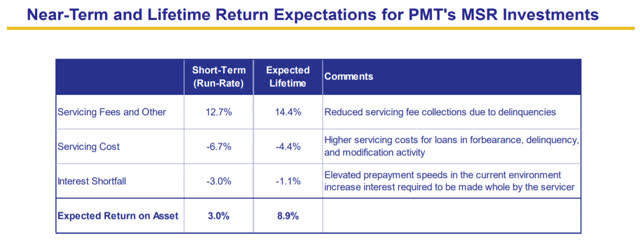

Source: Investor presentation

Here's an example that PennyMac provided. The risks to the model are listed to the right - including reduced fees due to delinquencies, higher servicing costs, and higher prepayment rates - but the bottom line is that the expected returns for its portfolio are greatly diminished. This may reverse at some point, but the issues listed aren't going to go away anytime soon, at least not according to prevailing conditions.

Source: Investor presentation

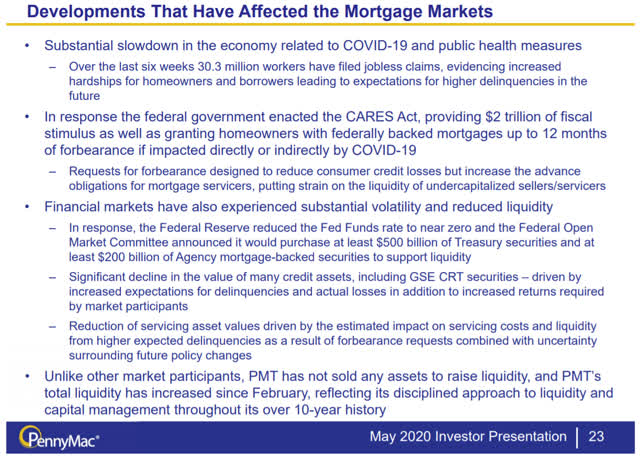

Speaking of prevailing conditions, the above succinctly outlines the problems facing PennyMac these days. I won't read them out to you, but suffice to say that extreme conditions have created some challenges for the market PennyMac operates in. This, as mentioned above, should make historical rates of return difficult to match - at least for the foreseeable future - which means the stock should be discounting this. At this point, I'm not sure that it is, so that's why I'm cautious.

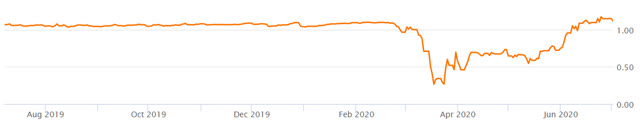

Below, we have the stock's price to tangible book value, which is a great way to measure the value of a REIT as it values the real property the trust owns. In PennyMac's case, these are financial instruments instead of buildings.

Source: Seeking Alpha

We can see the price to tangible book value ratio was very steady before the crisis, hovering around 1.0X to 1.1X for the quarters leading up to the crisis. That ratio fell to just 0.27X at the bottom in March, but has since rebounded significantly. As of now, price to tangible book is 1.11X, which is higher than it was pre-crisis.

In other words, either investors believe PennyMac has improved its business such that a higher valuation is warranted, or the stock is pricing in a recovery that hasn't yet occurred. The first option makes no sense and thus, it appears investors believe PennyMac's book value would have recovered meaningfully since the end of March. That may be, but it looks to me like that is likely priced in already.

Given this, I am forced to think that PennyMac is fully valued at best, and a bit expensive at worst. The dividend was raised for the Q2 payment, so that's a good sign. And to be fair, I'm not suggesting PennyMac is going to implode or that it is permanently impaired. What I am suggesting is that it is at least temporarily impaired, but that the share price is reflecting a reality where things are back to normal, or close to it.

I'm not bearish on PennyMac, but I think that if you want to own it, you can get a better price than 1.11X tangible book value. My suggestion is to wait for a pullback to at least 0.9X tangible book, which is a long way down from here, but would greatly increase the chance of capital appreciation versus today's full valuation.