Continuing with my set of articles on ACADIA Pharmaceuticals (NASDAQ:ACAD), this article will concentrate on the analysis of the upcoming opportunities the company is working under. In particular, it will focus on the opportunities in the DRP segment, MDD, and Schizophrenia segments. I will make sales forecasts of individual segments under different assumptions and perform a total company valuation.

In this article, I will be referring to the assumptions I made in my previous article titled: “Acadia Pharmaceuticals: The worst-case scenario for investors” and I will add a couple of new ones for evaluation purposes.

Assumption 1: Pimavanserin prescriptions.

I am assuming that patients who have a chronic disease (e.g. PDP, Alzheimer's disease psychosis, or Schizophrenia) and are prescribed the company’s medication (pimavanserin) will take one 34 mg dose daily for a year and will renew this prescription every year until their death.

So, the patients that the company has in its base will consist of those who were prescribed pimavanserin in the previous years plus patients prescribed in the current year, minus the patients who have died.

This reflects the logic with the total number of patients every year in any disease.

Assumption 2: Price.

The price for a 34mg pimavanserin capsule is $78/daily, which translates into $585/ weekly, $2,340/monthly, and $28,080/ annually.

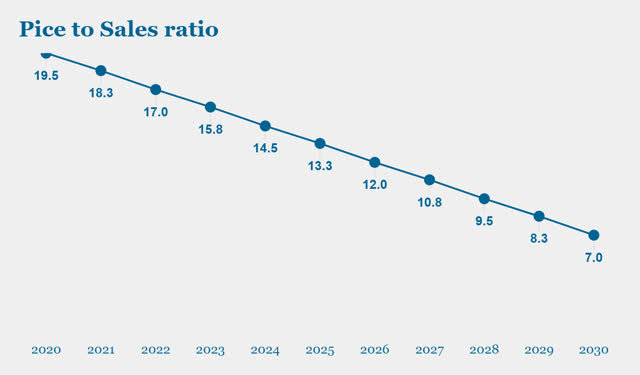

Assumption 3: Price to Sales ratio.

The general assumptions are for the P/S ratio to stand at the current value of 19.5x in 2020 and gradually move towards the current industry average of 7x by 2030. This implies that, by 2030, the company will have reached its growth stage potential and will have moved into a mature growth stage with average industry valuations and growth pace.

(Source: Chart created by the author)

DRP segment

In the last earnings report, the company confirmed its FDA supplementary submission this