Investment Thesis

Nikon Corporation (OTCPK:NINOY) offers a potential upside of 50%+ from the current stock price of ¥880 or $8.19 for NINOY. The market significantly underprices the company due to its exposure to a declining camera and lens market where Nikon lost some of its market share. My analysis shows that the imaging market will likely stabilize in the next five years, as sales to professional/amateur photographers and videographers will create a floor for the market. Moreover, Nikon will be able to stabilize its market share loss due to its strong push into videography and mirrorless technology.

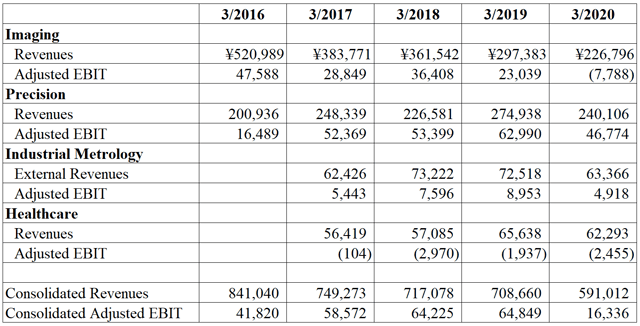

At the same time, the imaging segment is becoming less relevant for the company. It is Nikon's precision segment that will generate the bulk of the company's value going forward. While the market overemphasizes losses from the imaging segment, it is not factoring in profits from the precision segment. By selling advanced lithography equipment used in the production of semiconductors and flat panel display (FPD) screens, Nikon's precision segment will be able to absorb losses from the stabilizing imaging segment and derive the majority of the company's value in the long term.

Company Story

Nikon has widely been known as one of the top camera and lens producers. The company, together with Canon (CAJ), dominated the imaging market with their digital single-lens reflex (DSLR) cameras up until 2012. After that, it all went downhill. First, smartphones with improving cameras became ubiquitous. Then, mirrorless camera technology began gaining traction. Nikon was caught wrong-footed as it was late with introducing its first mirrorless cameras only in 2018. These two factors created a perfect storm for Nikon, and its imaging revenues declined in double digits.

Table 1. Nikon's Segment Revenues and Profits

Source: Nikon's financial reports, author's calculations. Adjusted EBIT values are calculated by adding

Photo by Andriy Blokhin

Photo by Andriy Blokhin