Overview

Veeva (NYSE:VEEV) is another cloud stock that we believe should provide investors with attractive long-term returns. Veeva has comprehensive and competitive life-science specific cloud solutions across CRM, data analytics, regulatory, content, and more. Having been in the business for 12 years, it has developed a solid brand reputation that enables it to virtually land life sciences enterprises of any size as its clients, effectively making it the market leader. Veeva's moat and fundamentals are rock solid, and it has been showing no signs of slowing down in recent times, partly accelerated by the COVID-19 related tailwind.

Catalyst

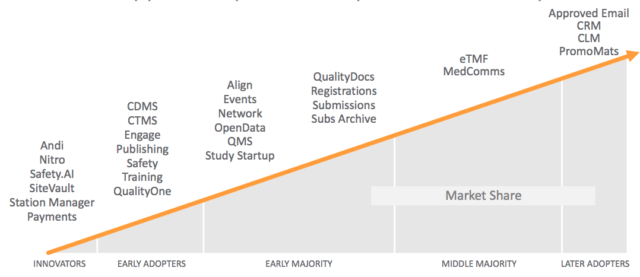

Looking at the comprehensive offering that Veeva has, we believe that it will continue to own the life science cloud solution space for the foreseeable future. Within an industry already characterized by high switching cost and entry barrier, Veeva closes almost all the gaps within the context of digital transformation with the breadth and depth of its offering.

(source: company's investor presentation)

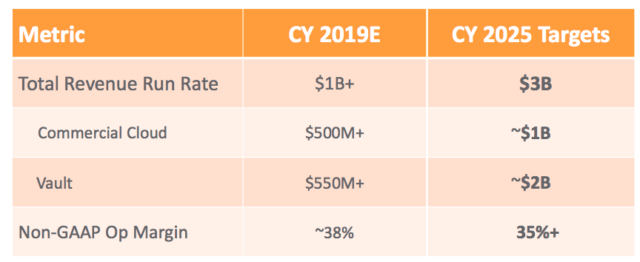

Consequently, adoptions for these offerings have been exceptionally strong, demonstrating their high mission criticalities. Revenue growth, for instance, has been accelerating instead of decelerating. Considering Veeva's scale and size, such a track record is impressive. Most SaaS companies we have covered typically see growth rate decaying to a more steady-state rate once they reach a certain size, to some extent indicating post-disruption market maturity or saturation. It is not the case with Veeva. Veeva posted a ~$1.1 billion of revenue last year and, currently, has a +$36 billion market cap. However, revenue growth has gone from +20% to +30% over the past two years.

(source: company's investor presentation)

With that in mind, we feel optimistic about its prospect in reaching a $3 billion revenue target by 2025 or roughly an expectation of consistent 30% growth each year. The track record today alone has shown