Earlier this year, I resumed coverage of the Magic Formula. Acuity Brands (NYSE:AYI) appeared in all the three screens that I performed since early March. Its stable presence points to the fact that the stock remains underappreciated in up and down markets. In this article, I will examine AYI as a potential stock pick. For now, it looks like there is reasonable value in the stock that is attractively priced in the context of this stock market.

For more information about the Magic Formula or the latest screen, please have a look at my last article (that should be open to non-subscribers).

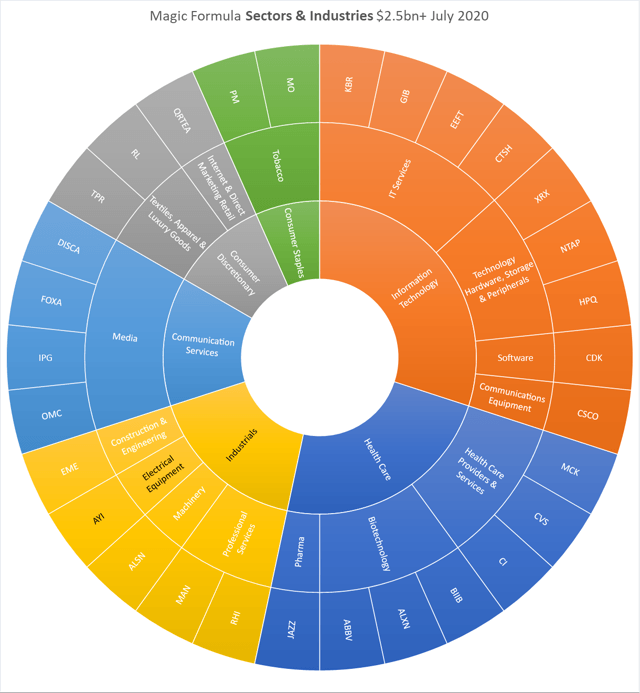

The chart below shows the tickers of the 30 Magic Formula stocks with a market cap of over $2.5bn, including their sectors and industries.

Source: compiled by author, magicformulainvesting.com was used to get the tickers, the sectors and industry classifications follow the GICS methodology.

There are different approaches possible to this collection of stocks, ranging from the rigid application of the Magic Formula investment script of buy & hold for 1 year, to using it as a source of potential stock ideas.

Magic Formula math

The Magic Formula bases its ranking on earnings yield and return on capital. The earnings yield is calculated as EBIT/EV and the return on capital as EBIT/(net working capital + net fixed assets).

Acuity's earnings yield is a straight forward 11% ($390m/$3,525m), which is pretty good. The NWC is $318m when leaving out operating lease liabilities and NFA is $275m which only consists of PP&E because the Magic Formula ignores intangible assets, and these two add up to $593m. The return on capital is, therefore, 66% as TTM EBIT is still the same $390m.

Needless to say, a 66% return on capital is very high and should indicate the presence of at least some competitive