Kirkland Lake Gold: Second Quarter Production Update

Kirkland Lake Gold (KL) has reported its Q2 2020 production results. I was expecting a weaker Q2 as a result of COVID-19 impacts on its operations, especially on its Detour Lake mine in Canada. However, Kirkland Lake Gold has surprised me quite a bit and reported stronger than expected output.

First, a little background on this company for newer subscribers, or those who may not be that familiar with this company.

I've owned Kirkland Lake Gold stock for years now. Newmarket Gold was a company Kirkland Lake acquired in 2016 for its Fosterville gold mine, and it has proved to be one of the greatest acquisitions in the sector. Newmarket was listed as my top gold stock pick for 2016, and then Kirkland Lake was my top pick in 2017.

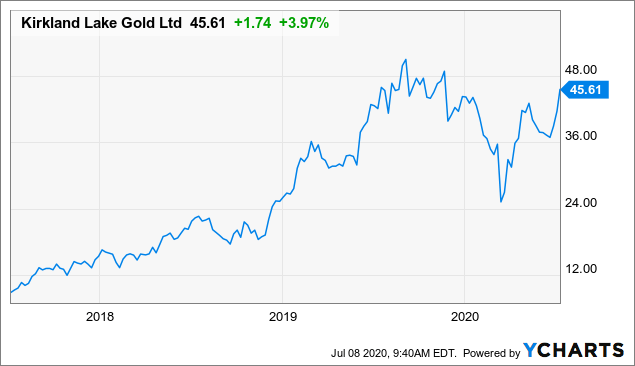

Back in May of 2020, the stock was struggling a bit, underperforming the benchmark VanEck gold miners index (GDX), and it traded at $34.79 per share at that time. It was lagging due to COVID-19 impacts on its operations, as it pulled its annual guidance and its 3-year guidance, on April 1. This uncertainty spooked investors a bit.

My most

recent coverage came back on May 20

, when I stated the following: "this weakness in its share price is likely temporary and I think any weakness in the stock price is a buying opportunity for investors focused on holding shares for at least 1 year..."Since then, the stock has risen by 20%, but are shares still worth buying after this latest production update? I break down the latest news and give my thoughts on the stock below.

Kirkland Lake Gold Q2 Production

COVID-19 impacts were less seriously than previously expected. Of course, there's always the possibility that a second wave of COVID-19 could

If you want more gold mining stock analysis, subscribe now to The Gold Bull Portfolio. I help my subscribers find the best money-making opportunities in the gold & silver sector.

Receive frequent updates on gold mining stocks, access to all of my top gold and silver stock picks and my real-life gold portfolio, a miner rating spreadsheet with buy/hold/sell ratings on 100+ miners, and access to all of my 900+ published articles. A 2-week free trial is available !

I offer a substantial discount on annual subscriptions as well, and I'm currently offering 10% off for any new subscriber.