Various factors continue to support stock markets and valuations in the SPDR S&P 500 Trust (NYSEARCA: SPY) are currently trading less than 6% below the record highs. But given the size and strength or these recent upward moves, it's also starting to look as though bullish sentiment may have reached extreme levels.

As this has occurred, the market's underlying macroeconomic fundamentals have deteriorated at an increasingly faster rate while indicating a more negative outlook for both global output and consumer demand levels over the next several quarters. Ultimately, this is a bearish scenario that could weigh heavily on U.S. markets once the current earnings season has finished. For these reasons, traders holding long positions in the SPDR S&P 500 Trust could face greater downside risk in the weeks ahead.

Source: International Monetary Fund

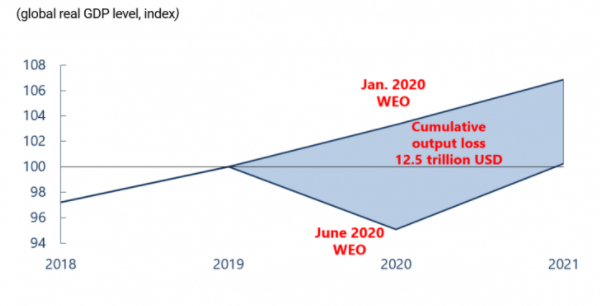

Perhaps the most significant problem that underlies the recent stock market rally is the fact that investors seem to be ignoring downside revisions to global output expectations for both 2020 and 2021. According to the International Monetary Fund (IMF), global output levels for 2020 are now expected to fall by 4.9%, which is nearly 2% lower than the IMF's prior forecast (released in April). These revisions also mark a massive divergence from the January projections calling for a 3.3% gain, so it would appear that prior hopes for an economic recovery were premature to say the least.

Source: International Monetary Fund

In addition to this, the IMF is now expecting a slower recovery period next year with cumulative losses in global output coming as a result of the COVID-19 pandemic totaling more than $12 trillion. Unprecedented losses like these can be difficult for individual investors to imagine and it would seem that the majority of the market is simply writing off these trends as temporary or transient in nature.