Author’s note: this article was released to members of CEF/ETF Income Laboratory on July 15, 2020. Please check latest data before investing.

The Weekly Closed-End Fund Roundup will be put out at the start of each week to summarize recent price movements in closed-end fund [CEF] sectors in the last week, as well as to highlight recently concluded or upcoming corporate actions on CEFs, such as tender offers. Most of the information has been sourced from CEFInsight or the Closed-End Fund Center. I will also link to some articles from Seeking Alpha that I have found for useful reading over the past week. The searchable tag for this feature is "cildoc". Data is taken from the close of Friday, July 10th, 2020.

Weekly performance roundup

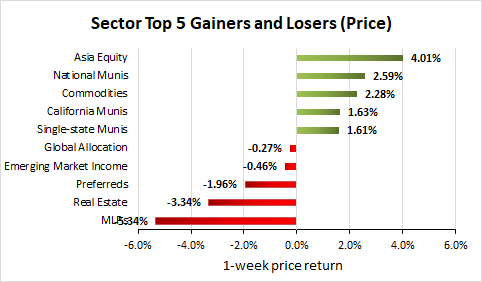

12 out of 23 sectors were positive on price (down from 22 last week) and the average price return was +0.27% (down from +2.01% last week). The lead gainer was Asia Equity (+4.01%) followed by National Munis (+2.59%), while the weakest sector by Price was Real Estate (-3.34%), followed by Preferreds (-1.96%) and Emerging Market Income (-0.46%).

(Source: Stanford Chemist, CEFConnect)

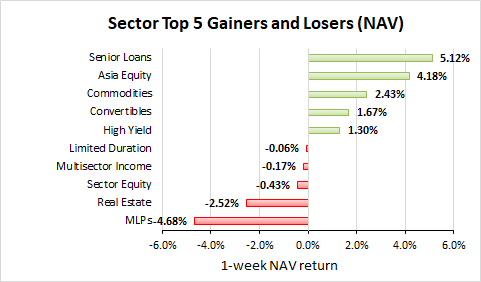

16 out of 23 sectors were positive on NAV (down from 21 last week), while the average NAV return was +0.58% (down from +1.61% last week). The top sectors by NAV were Senior Loans (+5.12%) and Asia Equity (+4.18%). The weakest sector by NAV were Real Estate (-2.52%), Sector Equity (-0.43%) and Multisector Income (-0.17%).

(Source: Stanford Chemist, CEFConnect)

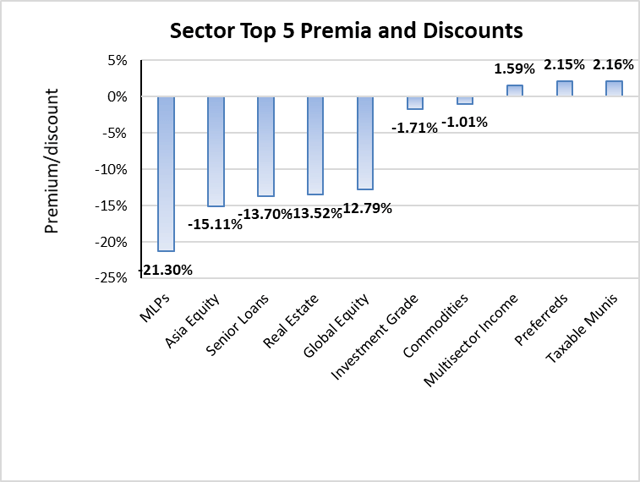

There were only three premium sectors this week, the leader was Taxable Munis (+2.16%), while the sector with the highest discount is MLPs (-21.30%). The average sector discount is -7.73% (down from -7.67% last week).

(Source: Stanford Chemist, CEFConnect)

The sector with the highest premium/discount increase was National Munis (+1.63%), Senior Loans (-0.27%) showed the lowest premium/discount decline. The average

Profitable CEF and ETF income and arbitrage ideas

Closed-end funds news and recommendations are now exclusive to members of CEF/ETF Income Laboratory. We also manage market-beating closed-end fund (CEF) and exchange-traded fund (ETF) portfolios targeting safe and reliable ~8% yields to make income investing easy for you. Check out what our members have to say about our service.