Introduction

Utility companies such as Entergy (NYSE:ETR) are often sought after for their relatively steady and predictable earnings that in turn should make their dividend safety high. On the surface this sounds quite reasonable; however, upon digging deeper, years of high capital expenditure have left their leverage taking an unsustainable path that ultimately calls into question the medium to long-term sustainability of their dividends. The type of company does not matter since no company, government or household can see their leverage increasing indefinitely.

Executive Summary and Ratings

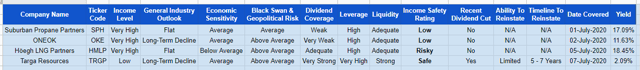

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. The following sections all provide further detailed analysis for those readers who are wishing to dig deeper into their situation.

Image Source: Author.

Ratings Summaries and System

Recently, I have taken actions to make my analysis more comparable between different companies and partnerships by introducing a more standardized rating system. A list of all my equivalent ratings as well as more information regarding my rating system can be found in the following Google Document. Whilst the list is only small at the moment, please check back across time since it will continue growing in tandem as my coverage continues growing.

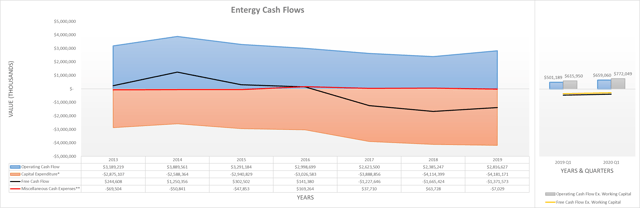

Image Source: Author.

Detailed Analysis

![]()

Image Source: Author.

Their historical cash flow performance was primarily included to provide context and thereby frame the subsequent analysis of their financial position. It can be seen that whilst their free cash flow was positive during 2013-2016, this has subsequently changed for the worse since their already sizeable capital expenditure increased even further. Although this is seldom a positive sign for a dividend investment, in theory it could be sustainable if their financial health has not been deteriorating because their investments produce sufficient returns. Since the