Bulls in the refining sector have argued almost since the COVID-19 pandemic began that U.S. gasoline demand will be higher than average this summer. The expectation of a more-than-complete recovery to U.S. gasoline demand is premised on the argument that Americans have, in response to the ongoing pandemic, abandoned flying in favor of cars for most long-distance travel. With states reopening their economies just in time for the summer vacation season, refining sector bulls believe that rising gasoline demand will more than offset the recent collapse of jet fuel demand.

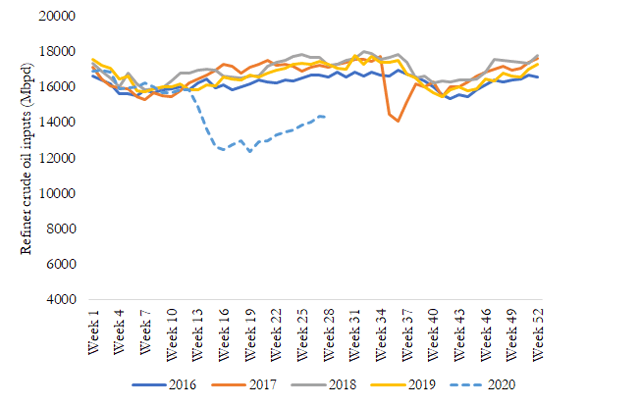

The outcome has very important implications for investors in merchant refiners such as CVR Energy (CVI), Delek US Holdings (DK), HollyFrontier (HFC), Marathon Petroleum (MPC), PBF Energy (PBF), Phillips 66 (PSX), and Valero Energy (VLO). Refineries across the U.S. have been operating at reduced capacities ever since lockdown orders were implemented in most states last March (see figure). While those orders were eased as early as April, a combination of high refined fuels stocks and resurging coronavirus transmission rates have prevented refining utilization rates from undergoing the "V-shaped" recovery that many analysts had anticipated (see figure). Indeed, refiners' weekly crude input volumes have remained at least 16% below the four-year average in July to date. This reduced throughput will be reflected in refiners' upcoming Q2 earnings reports and, as appears increasingly likely, possibly those of Q3 as well.

Source: EIA (2020)

The good news for merchant refiners is that the refined fuels demand from which they derive the bulk of their earnings normally peaks in July and early August as Americans go on vacation. This is especially true for gasoline demand, which historically experiences an increase on a weekly basis of as much as 20% or more between early January and late July. If Americans are responding to the lifting of pandemic-related restrictions by driving even more miles than usual, then gasoline demand should have fully recovered by now.

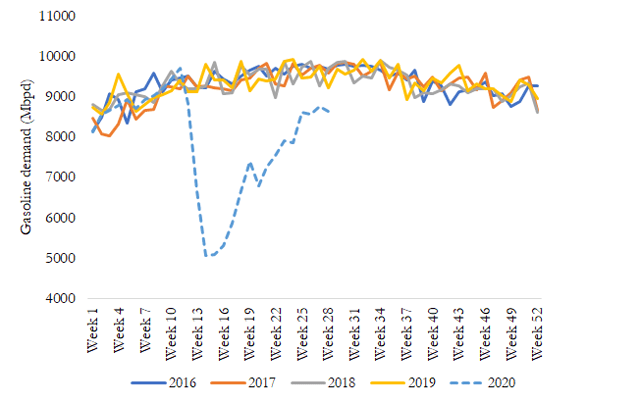

Unfortunately for the bullish argument, the opposite is happening. Gasoline demand did initially take on the shape of a "V" in April and early May as lockdown restrictions were lifted (see figure). The recovery rate slowed and has actually plateaued in recent weeks at approximately 8,600 Mbpd, however. Gasoline demand remains 10% below its four-year average at a time when it is normally approaching its annual high. The recent rate of the gasoline demand rebound makes it extremely unlikely that a full recovery will occur, let alone be exceeded, before gasoline demand begins its seasonal decline later in Q3.

Source: EIA (2020)

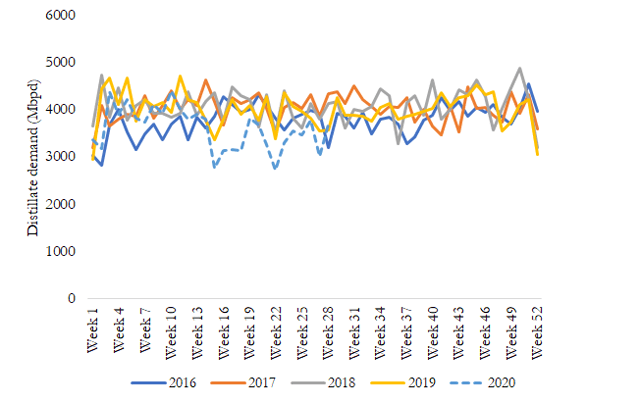

Weak demand does not, on its own, prove that Americans have avoided all forms of travel in response to the pandemic rather than just airliners. Two additional data points do much to confirm that gasoline demand is not benefiting from any such effect, however. The first data point is diesel fuel demand, which, while less variable on a seasonal basis than gasoline demand, has also been 10% below its own four-year average in recent weeks (see figure). Gasoline demand, in other words, is as weak as diesel fuel demand at a time when the former is normally climbing, both in absolute terms and relative to the latter. Whereas weak diesel fuel demand is a sign of overall economic weakness, weak gasoline demand does not align with the belief that refiners will benefit from a full recovery of their most important product.

Source: EIA (2020)

The second data point is the COVID-19 test positivity rate in the U.S., which has climbed from a low of 4.3% in June to a high of 8.8% in July on a seven-day moving average basis. The number of coronavirus tests being administered has surged in recent weeks and, unsurprisingly, this has led to a large increase in the daily number of new cases being reported. A stable or shrinking coronavirus transmission rate would cause the positivity rate, which is the ratio of total tests administered that are positive, to decline in response to larger testing numbers. The large increase to the U.S. positivity rate that has occurred over the last month strongly implies that the coronavirus is still spreading rapidly within the country.

The coronavirus's continued expansion in the U.S. is not occurring within a vacuum. State and local authorities, concerned by reports of hospitals and morgues being overwhelmed by an influx of patients with COVID-19, have begun to roll back their earlier economic reopenings in states such as California, Florida, and Texas. A recent report for the White House's coronavirus task force recommended that at least 18 states, including those three high-population states, initiate rollbacks of their recent reopenings. These renewed measures will only add to recent downward pressure on gasoline demand by reducing Americans' incentives to travel even by car.

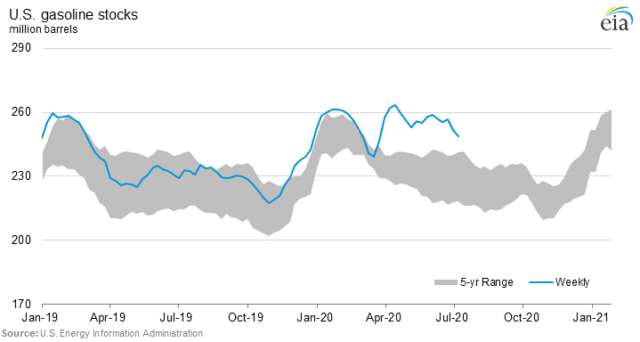

Taken together, then, these developments can be expected to prevent gasoline demand from reaching, let alone exceeding, their normal summer levels. Moreover, the prospect of a second wave - the summer's warm weather was supposed to slow the virus's growth and give the country a respite from the pandemic - in Q4 has only heightened as the country has failed to establish control over the transmission rate, making it likely that demand will remain weak through the rest of the year. Finally, gasoline stocks remain well above their usual summer range even if they have declined a bit from recent all-time highs (see figure). Investors should not expect refiners' utilization rates and earnings to fully recover anytime soon as a consequence.