Welcome to the July 2020 edition of the "junior" lithium miner news. I have categorized those lithium miners that won't likely be in production before 2022 as the juniors. Investors are reminded that most of the lithium juniors will most likely be needed in the mid and late 2020's to supply the booming electric vehicle [EV] and energy storage markets. This means investing in these companies requires a higher risk tolerance, and a longer time frame.

July was a busy month for news with some great achievements by the lithium juniors.

Lithium spot and contract price news

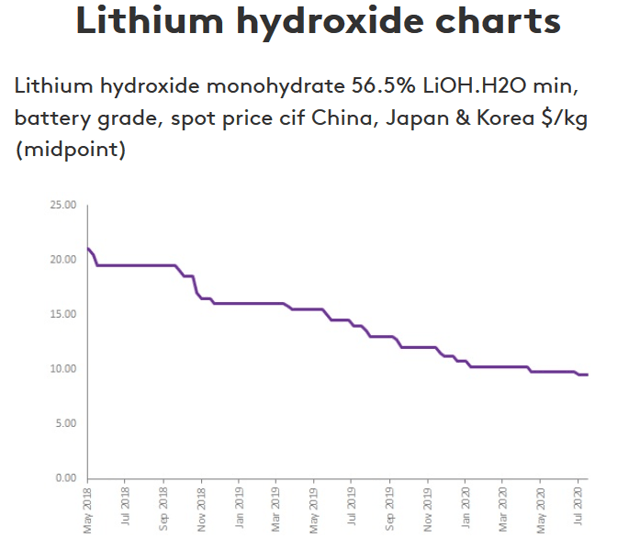

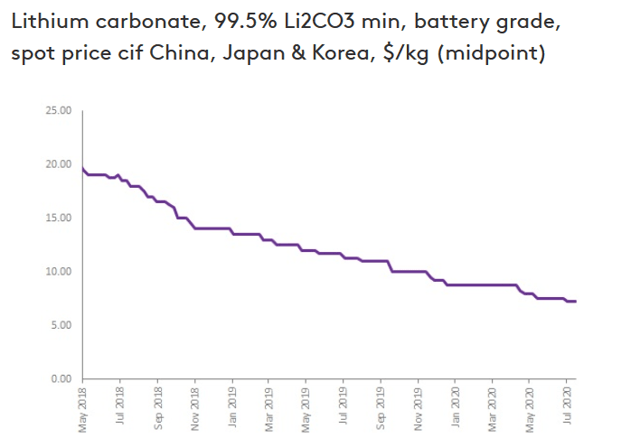

During July, 99.5% lithium carbonate China spot prices were down 0.36%. Lithium hydroxide prices were down 1.31%. Spodumene (5% min) prices were down 0.93%.

Fastmarkets (formerly Metal Bulletin) reports 99.5% lithium carbonate battery grade spot midpoint prices cif China, Japan & Korea of US$7.25/kg (US$7,250/t), and min 56.5% lithium hydroxide battery grade spot midpoint prices cif China, Japan & Korea of US$9.50/kg (US$9,500/t).

Benchmark Mineral Intelligence has June prices at US$6,552 for Li carbonate, US$8,772 for Li hydroxide, and US$393 for spodumene (6%).

Lithium hydroxide, battery grade, cif China, Japan & Korea

Lithium carbonate, battery grade, cif China, Japan & Korea

Source: Fastmarkets

Lithium market news

For a summary of the latest lithium market news and the "major" lithium company's news, investors can read my "Lithium Miners News For The Month Of July 2020" article. Highlights include:

- Benchmark Mineral Intelligence forecasts that by 2029, demand for nickel will double, while demand for cobalt will grow by three times, flake graphite by four times and lithium by more than six times.

- Simon Moores: US domestic supply chain build out “far too slow”. “It is not too late for the US, but action is needed now,

- CRU Group - “On the lithium side, that’s really favouring lithium hydroxide, which

Trend Investing

Thanks for reading the article. If you want to sign up for Trend Investing for my best investing ideas, latest trends, exclusive CEO interviews, chat room access to me, and to other sophisticated investors. You can benefit from the work I've done, especially in the electric vehicle and EV metals sector. You can learn more by reading "The Trend Investing Difference", "Subscriber Feedback On Trend Investing", or sign up here.