After reporting another solid quarter, Intel (NASDAQ:INTC) is collapsing to multi-month lows below $50. The chip giant is headed down the path of more chip delays, while losing multiple businesses that won't hurt results until the 2H. The company continues mounting lost business upon lost business, reinforcing my negative investment thesis.

Image Source: Intel website

Misleading Quarterly Beats

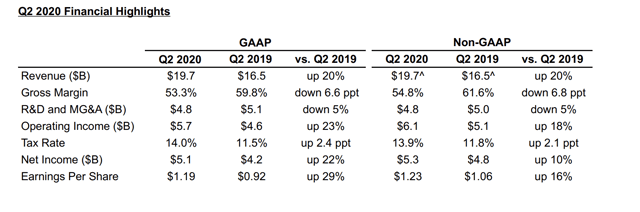

For Q2, Intel beat analyst estimates again by a large amount. The chip giant reported revenues of $19.7 billion versus analyst estimates of $18.55 billion for another quarter of revenue beats around $1 billion. Going back to Q2'19, Intel has beaten analyst estimates by roughly $1 billion each quarter.

The numbers are great on the surface, but the issues going forward are mounting for the chip giant. The revenue growth story falls apart in the 2H of the year, and the current margin compression story hits home really hard starting in Q3.

Starting with the margins, non-GAAP gross margins in Q2 were down 6.8 percentage points to only 54.8%. Despite the big revenue beat and 20% growth, Intel saw gross margins dip from 61.6% last year. Even with lower SG&A costs, the chip giant only dropped less than 50% of the revenue beat into operating income.

Source: Intel Q2'20 earnings release

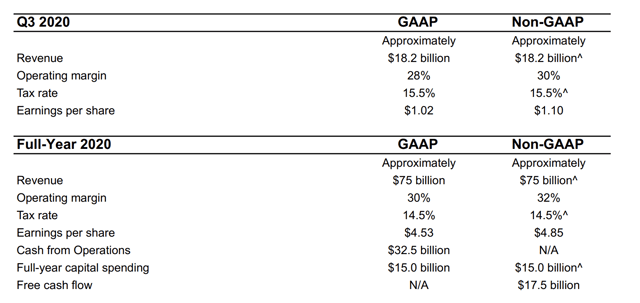

The full-year guidance has further red flags. Intel guided to a slight revenue boost for Q3 topping the $17.9 billion analyst estimate. The concerning part is that the chip giant guided down on EPS estimates to $1.10, down from the $1.14 analyst estimate.

Source: Intel Q2'20 earnings release

In addition, the way Intel provides the full-year guidance is misleading. The company places the revenue target at $75 billion, but it really fails to mention here that the boost to 2020 estimates only comes from the Q2 beat.

The end result is