ETF Overview

Vanguard Mega Cap Growth ETF (NYSEARCA:MGK) owns a portfolio of mega-cap growth stocks in the U.S. The fund has a high exposure to technology sector. This is advantageous because this sector should benefit from several megatrends in the next decade such as artificial intelligence, electric vehicle, 5G, and cloud computing. In addition, these technology stocks will benefit in a post-COVID-19 world as many people are forced to work from home. MGK’s shares are currently trading at a premium valuation. To mitigate this risk, investors may want to wait for a pullback or add shares incrementally and average down on any price weakness.

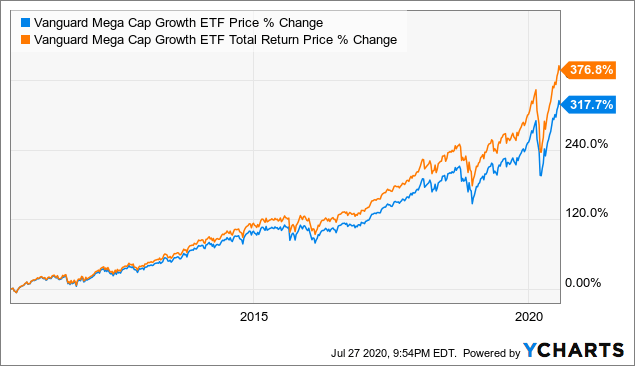

Data by YCharts

Data by YCharts

Fund Analysis

MGK constructs its portfolio based on stocks’ growth characteristics and market capitalizations

Before we analyze MGK and its portfolio, it will be helpful for investors to understand how MGK constructs its portfolio. MGK seeks to track the performance results of the CRSP US Mega Cap Growth Index. The index selects mega-cap U.S. stocks exhibiting the strongest growth characteristics. Metrics used to evaluate the growth characteristics include projected earnings per share growth, 3-year historical earnings and sales per share growth, return on assets, etc. The result is a portfolio of largest growth stocks in the U.S. market. These stocks include high-profile companies such as Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), etc. MGK currently has 114 stocks as of June 30, 2020.

MGK’s exposure to the technology sector is beneficial

MGK has a high exposure to the technology sector. As can be seen from the table below, technology sector represents about 46.3% of its total portfolio. MGK’s exposure to technology sector is advantageous for several reasons. First, there are several megatrends that will act as strong tailwinds for these stocks in MGK’s portfolio. These megatrends include artificial intelligence, autonomous vehicles, fifth generation wireless technology (also known as 5G), cloud computing, etc.