Give me the luxuries of life and I will willingly do without the necessities. - Frank Lloyd Wright

COVID-19 has disfigured and reconfigured the world in more ways than one can imagine. New trends have emerged, some trends have been banished for good, and we're all trying to make sense of how best we can put our money to good use in this new environment. Toll Brothers, Inc. (NYSE:TOL) looks to me, a company that has somewhat benefited from the disruptive phenomenon of COVID-19. It is the largest builder of "luxury homes" in the US with a presence across 24 states. As you can imagine, the word luxury puts you in a market where you're catering to a rather elitist class (TOL's average delivered home price last year worked out to almost $900,0000).

WFH and growing inequality - two consequences of the pandemic have helped drive resources to TOL's luxury proposition

So, why do I think TOL is well-positioned in this new environment? Firstly, 'work-from-home' (WFH) which was something of a less common practice a few years ago, has suddenly become the norm. I don't want to oversimplify complex human emotion, but there has been a lot of anecdotal evidence suggesting that large swathes of the populace are looking to base their work practices from home, to weather the risk of contagion. Alternatively, people have also been looking for a second home that is within driving distance from their primary residences. Add to that, you also have the recent phenomenon of Americans looking to move away from densely packed urban cities and apartment buildings. In a nutshell, people are looking for more space and more luxury.

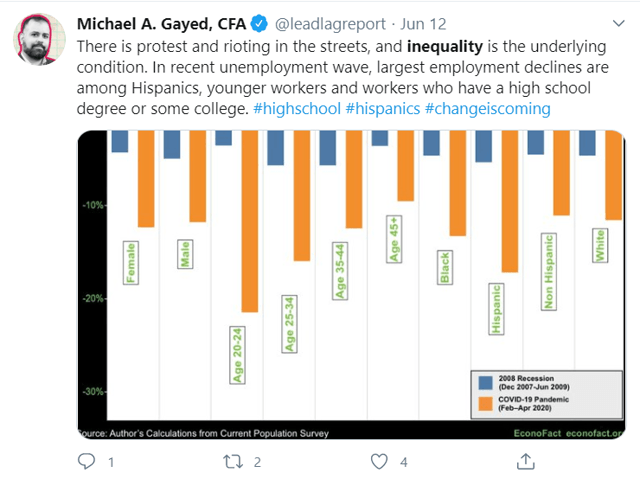

Then, those who have been following my commentary on the Lead-Lag report and Seeking Alpha will note that I've been highlighting the hazardous and ever-growing trend of inequality that has gained even more prominence since the pandemic. Through its actions, the Fed has been instrumental in funneling through even more resources to high-end buyers, or those who dabble in luxurious purchases.

So, in a nutshell, you have a real strong desire, and you also have strong financial resources and conditions supporting this desire.

The broad housing market and the luxury housing markets are ablaze.

Before I provide some color on the niche luxury housing market, I want to touch upon the broad housing market that is in fine fettle at the moment.

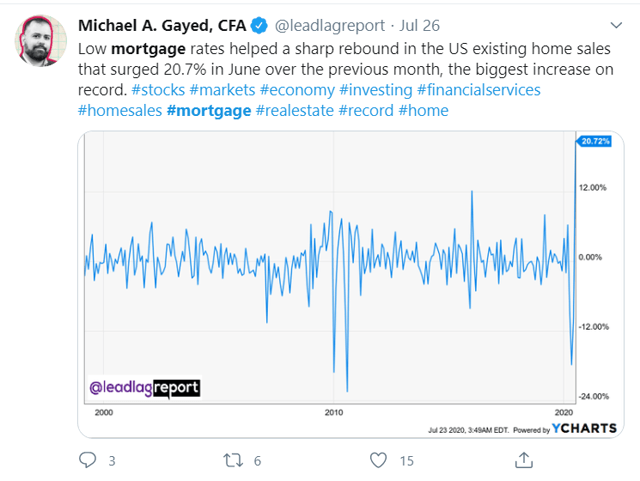

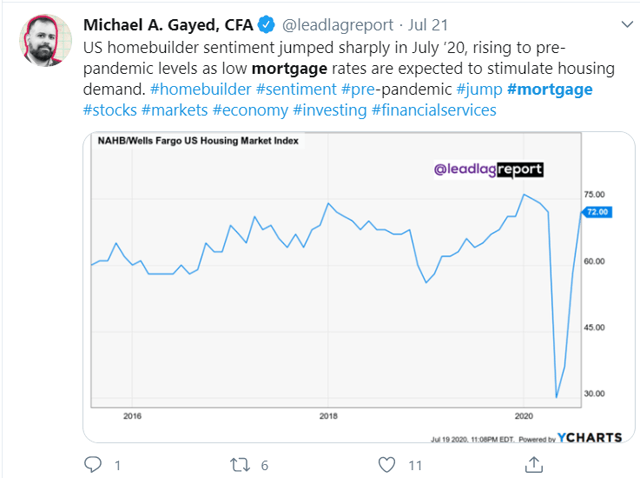

As mentioned in The Lead-Lag Report, financing conditions are extremely alluring with the 30-year mortgage rate dipping below 3% for the first time ever (a year ago, it was at 3.81%, and at the start of the year, it was at 3.72%). This has led to a spurt in home sales with US existing home sales hitting record monthly highs, and the level of homeownership hitting 68%, the highest since 2008. Homebuilders have been quick to latch on to this, with sentiment now at levels seen before the pandemic. Potentially, one could make a case for 30-year rates to continue to drift lower, as supply so far has been tight, and this may likely ease as more homes come to the market.

Unlike the previous housing crisis, luxury housing has been instrumental in leading the current recovery. Before COVID-19, luxury home sales only accounted for 18% of real estate transactions, but now, they account for 30%. Realtor.com in its luxury housing report mentioned that luxury residences have been instrumental in driving up the average median price gain of the overall housing market. Supply still continues to be an issue here, benefiting the sellers. The total inventory of U.S. homes priced at $1 million or more declined by 14% annually in June 2020. Besides, greater than $1 million worth residences that were on the market took 89 days to find new owners in May, a good two weeks longer than a year ago.

TOL's client base has better financial and credit profiles

TOL's client base is generally more affluent, has better job security, and has multiple sources of wealth, vis-à-vis the client base of its peers in the low and middle end of the housing market. I've questioned if the recent housing momentum can last when unemployment levels are quite elevated, but I do feel that this risk is less pronounced when it comes to TOL's client base. Firstly, about 20% of their client base doesn't take out a mortgage and fund their purchase via cash. Then, the average FICO scores for their client base are also quite elevated at 760. TOL also requires prospective buyers to put down quite a sizable non-refundable booking deposit of $70,000, which buyers are often unwilling to lose. This has meant that their cancellation rates are very low. As a percentage of their backlog, the cancellation rates both in Q1 and Q2 (TOL reports on an October year ending basis) came in at just 3%. Worth noting that, even during the previous housing crisis, between 2007 and 2011, their cancellation rates were much lower than the industry average.

Good Q2 results and outlook

Despite some adverse macro circumstances at the start of Q2 (October year ending), TOL was able to make up for lost ground and closed the quarter strongly. Revenue of $1.55bn beat street estimates by c.5%. The company also delivered gross margins of 21% that beat expectations, driven by pre-COVID-19 pricing power, stronger cost controls, and a favorable mix of deliveries. What was most encouraging though was how they closed the quarter. Client deposits represent a key leading indicator (deposits precede sales conversion by about three weeks), and this was up 13% in the last three weeks of May. Besides their deposits to contract conversion ratio has continued to remain steady at 65% and has not dipped below pre-pandemic levels. Web traffic has exceeded pre-COVID levels, and foot traffic in sales centers has also picked up from the weakness seen in March and April. Even if weakness were to return, I do think this is a business in good hands, with top management being around for more than 16 years and already having experienced the previous crisis. I liked their agility in responding to the crisis in March by taking out c.$50m from their SG&A cost base (50% of this benefit will come through in H2 of this year).

Technical analysis

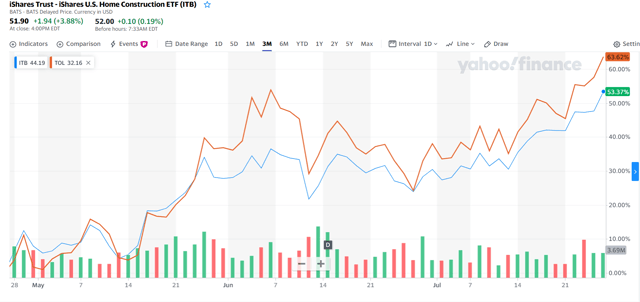

The TOL stock has been gaining steam over recent months. Whilst, on a YTD basis, it is yet to post positive returns (down c.6%) and lags its home construction peer-group - ITB (up 17% for the year), over the last three months, the former (up +63%) has outperformed the latter (up +53%), highlighting the scale of TOL's recent relative momentum.

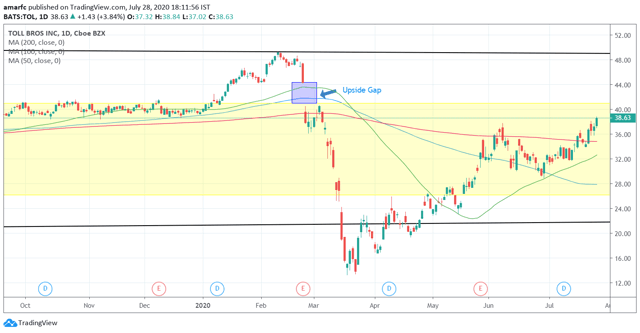

For a bigger picture, we look at the monthly chart below, and we can see that range expansion has been narrowing over time (the range from 2005 to 2009 was a lot wider than it has been since 2013 or so) in the shape of two converging trendlines. In March, the stock had given up about two-thirds of its value, dropping below the lower boundary and hitting $16. Yet still, when one feared the worst, it managed to surprise and show strong fire-fighting qualities at the lower levels, rebounding back above the lower trendline and into the previous congestion zone highlighted in yellow.

The stock currently has the wind in its sails as can be seen on the daily chart below, with the 50DMA crossing the 100DMA in early July, and the stock also recently breaking past the 200DMA, a good indication that the bears have lost the initiative. That said, looking ahead, I think one could make a case for the stock covering the upside gap below $44 and then perhaps even retesting the upper trendline on the monthly chart, which is around $50. A breach beyond $50 may well be challenging and will depend on some additional positive news flow-either company-specific or stimulus-related. In the absence of this, in all probability, one may likely see some accumulation within the yellow highlighted zone, which has previously served as an area for the stock to pause.

Risks

Having highlighted some of the appealing themes around the TOL story let me now flag certain risks.

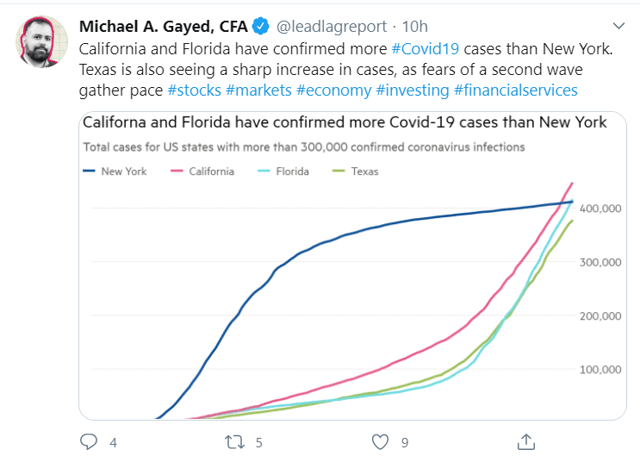

California market exposure could be impacted by a second wave and US-China relations.

TOL is quite heavily exposed to the California market with annual sales of more than $2,100 million or more than 30% of group revenue coming from that market. Luxury housing momentum in the state has bounced strongly, especially in key cities such as LA, where in June, one saw luxury housing deals of over $2 million increase by c.34% YoY compared to a -48.5% YoY decline in May. So far, so good. But, as I mentioned in my tweet below, the pace of growth of infections in the state relative to some of the other regions is a real cause for worry and may put the brakes on recent momentum.

The other risk which I don't think the market has quite digested is the worsening US-China relations. Now, as you know, property demand and luxury property demand, in particular, don't just come from the domestic populace alone. There is often a significant contingent of international Asian investors that are quite instrumental in driving demand and propping up luxury home prices. In fact, the Chairman of TOL had previously acknowledged that Chinese buyers tend to have a predilection for owning property in California - in the belts of Orange County and Southern California. It is believed that c.22% of homes sold in California are sold to foreign investors. Even before the health pandemic, one has already seen the Chinese government curb international investments, and the recent tussle between the two countries may likely temper appetite from this class of foreign investors.

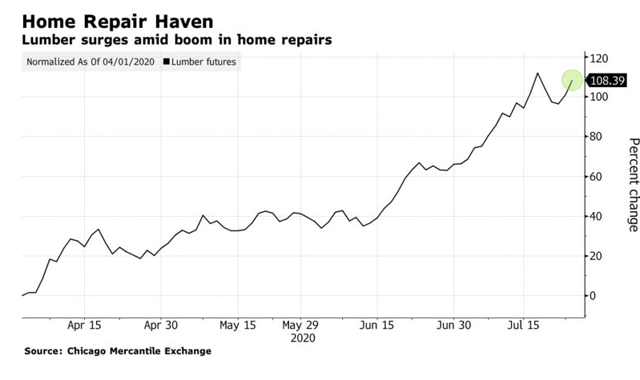

Spike in lumber prices

Subscribers of the Lead-Lag report will note the importance I attach to lumber prices as a risk-on/risk-off indicator by virtue of its role in house building. Regardless of its risk measuring qualities, there's no doubt that it will likely burn a hole in TOL's pockets, as prices have doubled since April, and the commodity is now incidentally the top-performing raw material in 2020. TOL's gross margins in the current and next quarter could be affected by this.

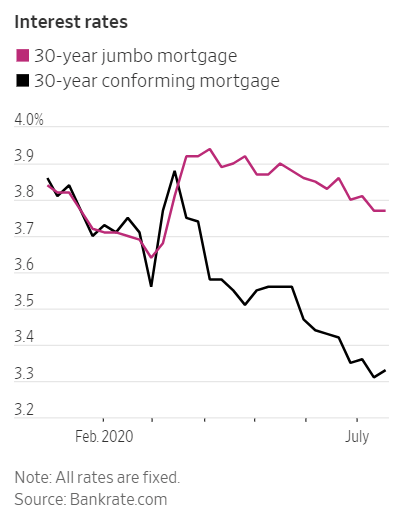

Jumbo mortgages will likely slow

It's worth noting that a lot of these luxury houses get financed via jumbo mortgages (provided to wealthy borrowers). For banks, the risks associated with jumbo mortgages (>$510,400) are sizable, as it cannot be sold to Fannie Mae or Freddie Mac, and these loans are often kept on banks' books, rather than sold in the secondary market. The banks attempt to mitigate the high risk by asking for a higher down payment. Crucially, these jumbo mortgages don't receive any forbearance benefit under the CARES Act whereby homeowners can request for 12 months of postponed mortgage payments. Under the current circumstances, I believe that banks will look to curb enthusiasm for this product. During the previous housing crisis in 2009, delinquency rates on jumbos had tripled and by February 2010, one in ten jumbos were 'seriously delinquent (arrears of >60 days). Attempts to put off buyers are being reflected in the 30-year jumbo mortgage rate which is currently c.40bps more than the average rate on normal conforming mortgages (source: Bankrate). This is in contrast to the conditions that were prevalent from 2015 until early Q2 this year when rates on jumbos were lower than or equal to conforming mortgages (which are backed by Fannie Mae and Freddie Mac). The reason I bring this up is that about 25% of TOL's houses are financed via jumbo mortgages, and we may see some slowdown here.

Summing up

The US housing market, and luxury housing market, in particular, is showing solid form, and TOL should continue to benefit from this with low mortgage rates and supply-side issues. The company finished last quarter on a strong note, and that momentum has carried on. The stock too is on a good run, outperforming its peer group over the last three months, and recently crossed the 200DMA, but it has now come to a congestion zone and is not too far away from some crucial resistance points. Investors should also consider potential challenges related to the California market (30% exposure for TOL), steep lumber prices, and a likely dip in jumbo mortgages (25% exposure for TOL). I'm neutral with a slight bullish bias.

*Like this article? Don't forget to hit the Follow button above!