Thesis Summary

The Vanguard Mega Cap Growth ETF (NYSEARCA:MGK) tracks the performance of a benchmark index that lists the return on investments of the largest-capitalization growth stocks local to the United States.

I believe it is a good buy for all investors as I expect it to continue to perform comparatively better in the economic downturn. It is going to be driven by the sustained growth of stocks like Amazon (AMZN), Apple (AAPL), and Microsoft (MSFT). Overall, it is a well-balanced portfolio with significant investment in consumer cyclical, technology, and communications stocks. It has performed well historically and should be able to sustain it in the expected recession.

ETF Overview

MGK is an open-ended fund that indexes the performance of the CRSP US Mega Cap Growth Index. It is a float-based, weighted index that uses market capitalization to invest in stocks showing the highest growth. This selection is made based on six factors:

- Forecasted long-term growth in earnings per share (EPS)

- Future short-term growth in EPS

- Three-year historical growth in EPS

- Three-year historical increase in sales per share

- Current investment-to-assets ratio

- Return on assets.

The fund has 32% exposure to cyclical sectors, like consumer cyclical and financial services, and 58% exposure to sensitive sectors like communications and technology.

Once you see the holdings table below, this will make sense as the fund is allocated to Microsoft at 12%, Apple 11%, Amazon 9%, Alphabet (GOOG) (GOOGL) 7%, and Facebook (FB) 4%.

Take a look at the top 25 holdings of the MGK:

Source: YCharts

As we can see, the top 5 holdings of the fund are communication services and technology, except for Amazon, which is classified as consumer cyclical.

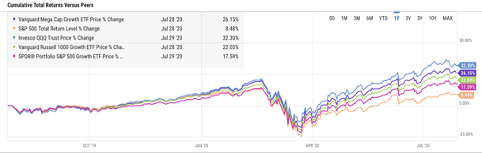

Let us take a look at the performance of the fund:

Source: YCharts

We can see how the fund has outperformed