Last month I cautioned investors that while ethanol production margins at the time were "flying high," the operating outlook made it unlikely that they would continue to do so for very long. I based my assessment on the fact that gasoline (and, by extension, ethanol) demand is falling well short of historical levels this summer, let alone April's bullish expectations. A growing surfeit of gasoline and ethanol inventories further meant that, absent a major increase to the price of the former, ethanol margins would quickly decline as ethanol producers restarted production at facilities that had been idled in response to March's severe ethanol demand disruption.

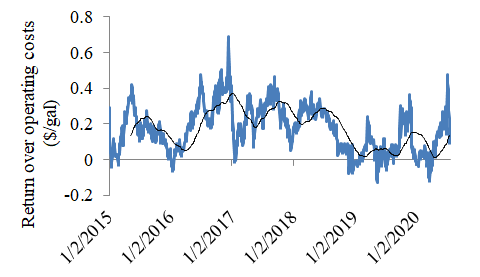

Ethanol production margins have indeed lost ground over the last month, with those of a hypothetical dry-mill facility in Iowa having fallen from a peak of $0.45/gallon in early July to as low as $0.10/gallon more recently (see figure). Importantly, margins have remained below the cost of capital since mid-July, to the detriment of heavily-indebted producers such as Green Plains, Inc. (GPRE) and Pacific Ethanol (PEIX). REX American Resources (REX), which does not carry any debt on its balance sheet, is once again the strongest of those three producers as a result.

Ethanol production margins for a hypothetical dry-mill facility in Iowa. Source: CARD (2020).

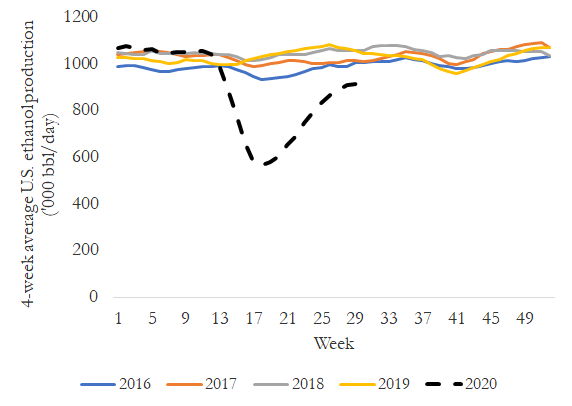

Ethanol production margins have fallen as the sector has returned to a state of over-production. Margins increased starting in April as the impacts of the COVID-19 pandemic and related economic shutdowns prompted the ethanol sector to idle a substantial fraction of its total production capacity. Gasoline prices rapidly rebounded between late April and June as the lockdown orders were lifted, though. The combination of reduced supply and higher commodity prices caused ethanol margins to rapidly increase to multi-year highs in May and June. At that point, producers quickly restarted production, mostly eliminating the YoY deficit within a few weeks (see figure).

Source: EIA (2020).

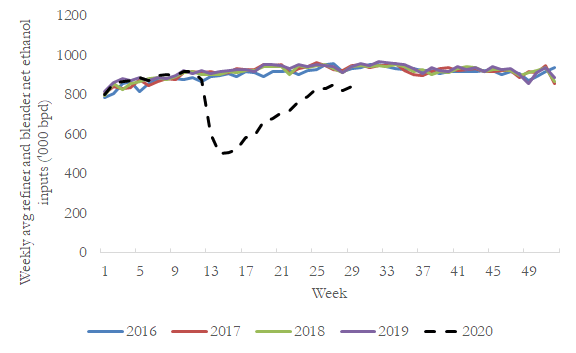

Unfortunately for ethanol producers, demand has not fully recovered despite rebounding in May and June. Weekly ethanol inputs by refiners and blenders have remained approximately 10% below the 4-year average over the last month even as the peak of the summer driving season has approached (see figure). With production volumes lower by a similar amount, the continued (if reduced) presence of idled capacity has been a headwind to the sector's margins.

Source: EIA (2020).

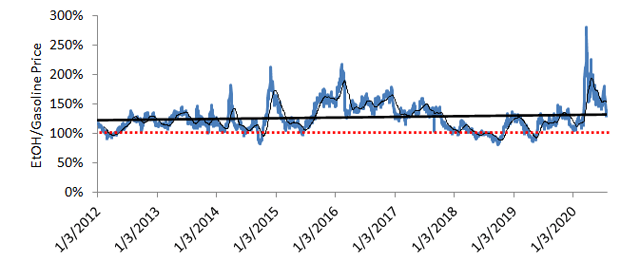

This weakness is illustrated by the decline of the ethanol price premium over gasoline to its long-term average (see figure). The ethanol price premium increases when insufficient supply is available to refiners and blenders, as occurred during the mass idling of production facilities in March and April. That premium mostly disappeared in July, however, providing further evidence that the earlier supply shortages no longer exist.

Sources: CARD, EIA (2020).

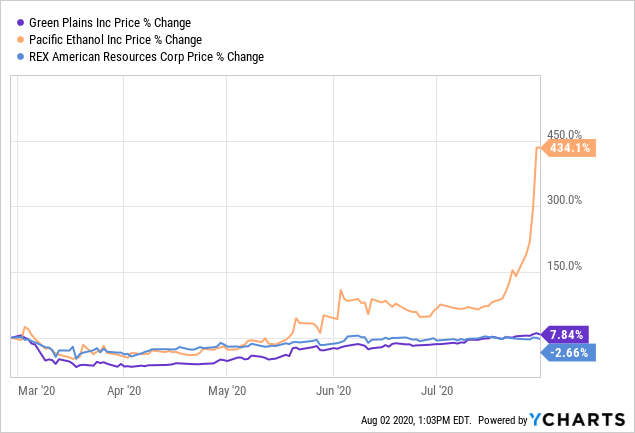

The share prices of U.S. independent ethanol producers have largely returned to their pre-pandemic, if not pre-2020, levels (see figure). That of Pacific Ethanol, which plunged in the first months of the year due to its heavily-indebted balance sheet, even engaged in an impressive relief rally as margins rebounded. Investors had feared the worst when ethanol demand collapsed in March and April as many analysts predicted that one or more major bankruptcies would affect the sector. That has not happened due to the combination of U.S. government support and the margin rebound, as shown by the rallying share prices.

Data by YCharts

Data by YCharts

Bullishness aside, investors should be especially cautious this week as producers begin to release their Q2 earnings reports. At first glance, these earnings can be expected to reflect the production margin recovery that hit full stride in May and June. The rally in producers' share prices that occurred over the same period is indicative of such an expectation by the market. While each producer's situation has been unique due to the pandemic's disparate impacts, however, the Q2 earnings report that was released by Valero Energy (VLO), which is one of America's largest ethanol producers, last week showed just how challenging the quarter's operating environment had been. Valero's Ethanol segment reported a negative adjusted operating income for the quarter that it attributed to the combination of lower ethanol prices and a YoY production volume decline of almost 50%. While the company undoubtedly experienced some of the benefit of the quarter's margin recovery, this was unable to offset the impact of reduced production volumes.

The current operating environment also makes it more important than ever for investors to focus on the operating outlooks that are provided by ethanol producers' management teams during the companies' Q2 earnings calls. The subsequent collapse of margins in Q3 to date even as production volumes have mostly recovered will make it difficult for any earnings tailwinds that may have existed in Q2 to persist. Ethanol producers have operated within an unusually-low margin environment since late 2018 as production has managed to exceed even near-record ethanol demand. The collapse of U.S. ethanol exports in Q2 removed an important relief valve for the sector, and the recent stalling of the domestic ethanol demand recovery makes it increasingly likely that 2019's demand volume will be higher than in 2020 or even 2021.

The U.S. ethanol sector has fared better during the first months of the COVID-19 pandemic than many analysts had predicted. June was a high-water point in the sector's subsequent recovery, however, and the ethanol operating environment has worsened over the last month as the pandemic's negative impacts have persisted in the U.S. Investors should not expect producers' share prices to return to the highs of recent years until the current state of overproduction abates and ethanol demand returns to pre-2020 highs.