Yandex (NASDAQ: YNDX) is Russia's premier high-tech company with annual revenues of roughly $2.8 billion from a variety of online or online-enabled businesses including internet search, taxi and ride-hailing, food delivery, classifieds, e-commerce and online media services.

Source: archello.com

In my March 8, 2020 article about YNDX, I concluded:

Trading at a 32.9% discount to estimated value, we could easily see YNDX appreciate 50% from the current levels to about $60.00 per share over the next 3 to 5 years.

A lot has changed since that time and for this investor, it was time to sell. Now, I'll explain why.

Increased Global Risk

Over the past few months the world has simply become a riskier place. COVID-19 has proved a stubborn virus with deaths worldwide climbing toward 700,000 (about 14,000 in Russia). The impact of quarantines, new disease protocols and other efforts to slow the spread of the virus have sent unemployment skyrocketing while national GDP's plummeted to recession levels. Increases in the money supplies of many countries have raised serious questions about sovereign debt and political unrest has sent crowds to the streets - even Russia.

SOURCE: worldpoliticsreview.com

Stock markets everywhere have experienced increased volatility while companies have seen revenue evaporate. For investors in YNDX, the scales may have tipped in favor of risk management over "fear of missing out."

Disappearing Revenue

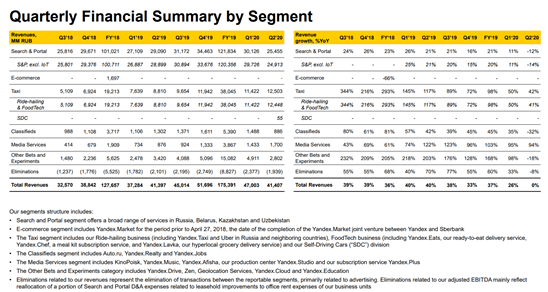

There are several reasons to own YNDX. The company is 1) the biggest, safest high-tech play on the Russian and CIS markets, 2) providing diversification for non-Russian investors, 3) with acknowledged technological leadership in businesses with long-term potential, and 4) until recently, stellar revenue growth. In fact, revenue growth has disappeared. The following is a slide from the 2Q 2020 Investor Presentation.

Source: YNDX 2Q 2020 Investor Presentation

If we follow the very last column on the