Editor's note: Seeking Alpha is proud to welcome Simeon Hyman, CFA as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Where Dividends Stand Midyear

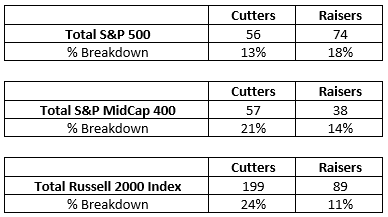

The United States and countries around the world are in various stages of reopening, but financial markets are still wary and dividend cuts in the U.S. equity market have continued. We have also seen a continued pattern of significant dividend resilience based on credit quality.

Figure 1: Dividend Scorecard

Dividend Cutters versus Dividend Raisers, by Market Cap

Source: Bloomberg, ProShares. Based on DPS announcements from 1/1/20–6/22/20 broken down as a percentage of dividend payers in each index. Past performance is no guarantee of future results. Chart is provided for illustrative purposes.

What Makes the Dividend Aristocrats Resilient? Quality.

There is an elite group of companies that has been less susceptible to dividend cuts this year. So far, just one company among the S&P 500 Dividend Aristocrats Index has cut its dividend. To become a Dividend Aristocrat, an S&P 500 company has to increase its dividends for a minimum of 25 consecutive years. Many of the Dividend Aristocrats have actually raised their dividends continuously for 40 years, 50 years or more. This is relevant for today’s investors because that 25-year minimum requirement means the Dividend Aristocrats have increased their dividends even through the Great Recession, the bursting of the dot-com bubble, and many more market disruptions.

What is one likely source of their resiliency, both current and historical? Their credit quality. In our previous Dividend Viewpoint article, The Quality-Based Differences Developing in Dividends, we showed how both current dividend cuts, and cuts during the Great Recession, came disproportionately from lower