Co-produced with Trapping Value

Back in April, we reiterated our bullish stance on Aberdeen Global Premier Properties Fund (NYSE:AWP), a global real estate closed-end fund. Our recommendation was based on its deeper than usual discount to NAV, sector diversification, limited leverage, competitive fees, yield and its performance relative to its benchmark. We also wanted to cash in on the mass hysteria prevalent at that time and the horrible sentiment for anything real estate. We had concluded with:

In the long run, real estate values go up. They certainly will go higher in this environment of exceptionally low rates. Yes the virus will dampen activity, and sure, certain tenants may get temporary rent breaks. On the whole though, 95%-99% of their revenue stream will not even change in the medium term. That has been coupled with a selloff the likes of which we have never seen. So REITs are very cheap in relation to fundamentals. With AWP you can buy the best of all of them together. Investors should grab this opportunity with both hands and buy for yield and capital appreciation.

Source: AWP: One Of The Safest High Yields In Today's Market

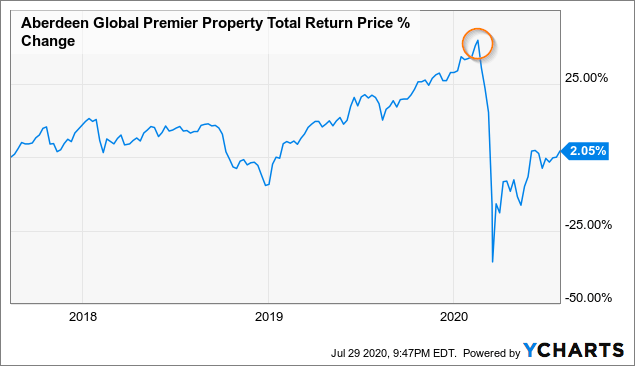

Although it has been through volatile swings, the price is more or less unchanged since then. To be fair though, four months do not make “long run” unless you have the constitution of a Robinhood Trader. This fund has been part of our model portfolio since August 2017 and up until earlier this year, the total returns looked like this:

Currently AWP yields 9.9%. We stand by our thesis that this deep discount merely provides an opportunity to buy a well-managed global real estate fund at a double discount and lock in a higher yield on cost. For those already holding it, it provides an opportunity to average down

High Dividend Opportunities, #1 On Seeking Alpha

HDO is the largest and most exciting community of income investors and retirees with over +4300 members. Our Immediate Income Method generates strong returns, regardless of market volatility, making retirement investing less stressful, simple and straightforward.

Invest with the Best! Join us to get instant-access to our model portfolio targeting 9-10% yield, our preferred stock and Bond portfolio, and income tracking tools. Don't miss out on the Power of Dividends! Start your free two-week trial today!