Avid Technology (AVID) offers solutions for video and audio content creation, management, and distribution. The company, like so many others, has a bit of a rough time due to the pandemic which is halting performances and productions and complicating logistics and making the life of ad supported media companies (customers of Avid) more difficult, but the management has adapted rapidly to the new environment and Q2 showed some surprising strengths.

We believe that there is more in stall as the company benefits from an ongoing shift towards recurring revenues, including software subscriptions and has been cutting cost in an accelerated fashion.

Reasons for optimism

- Shift to SaaS

- Big clients signing up

- Decreasing COGS

- Reducing OpEx

- Gradual recovery of hardware

Recurring revenue

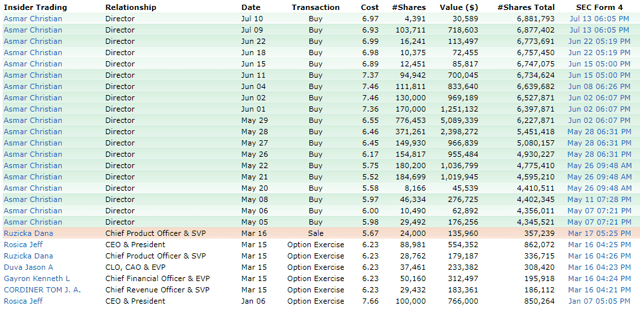

The company is gradually shifting towards a SaaS model generating recurring subscription software revenues. From the earnings deck:

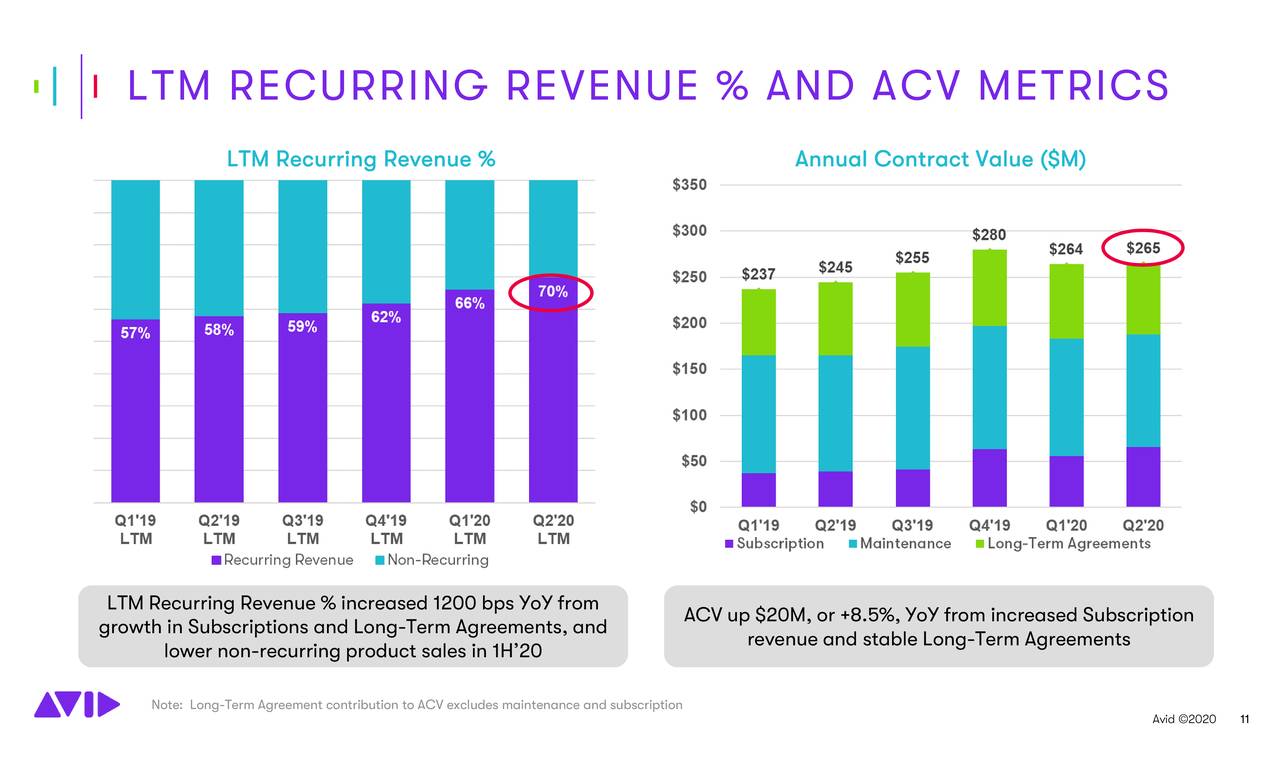

The jump in Q2 to 70% of revenue is of course a bit inflated and to a significant extent the result of the sharp decline in hardware sales (-50% in Q2), but nevertheless the number of cloud customers keeps on increasing (+64% in Q2), so it's not a temporary issue but a well established trend (earnings deck):

You might also notice that the recurring revenue stream actually consists of three streams:

- Subscription ($16.4M, +68% y/y)

- Maintenance ($30.6M, -3% y/y)

- Long-Term Agreements (+8% y/y)

The largest component is actually maintenance so the company isn't predominantly a SaaS company, but these maintenance revenues are recurring but slowly declining as a result of the end of support of legacy storage solutions and lower product sales (-3.4% to $30.6M in Q2).

Within the recurring revenue there is a shift from monthly to annual upfront payments, which is a higher quality revenue stream and the result of pricing changes implemented last year.

Of course Cloud offerings like Avid Edit On Demand is benefiting from tailwinds as it enables remote workers and distributed workflows at studios and production companies to keep on working, despite closed facilities.

Big clients

Last fall, there was of course a partnership with Disney (DIS) and Microsoft (MSFT), from Televisual:

The two companies have teamed with Avid and will use Avid's various solutions for collaborative editing, content archiving, active backup and production continuity all running natively on Azure.

The innovation partnership will be run through The Walt Disney Studios' StudioLAB, Disney's technology hub, and will be aimed at delivering cloud-based solutions for production and postproduction or from "scene to screen."

And there are more lining up (Q2CC):

And as we've mentioned, we haven't named the company yet, but there was another major media company that we signed an agreement with in Q1 that started to convert to revenue in Q2. Where others that we signed around the world that are - maybe not as large as those two, they're pretty significant size companies, and those are starting hopefully to contribute in the second half.

So much so that the team handling these big accounts is "almost overtaxed" according to management.

Margins

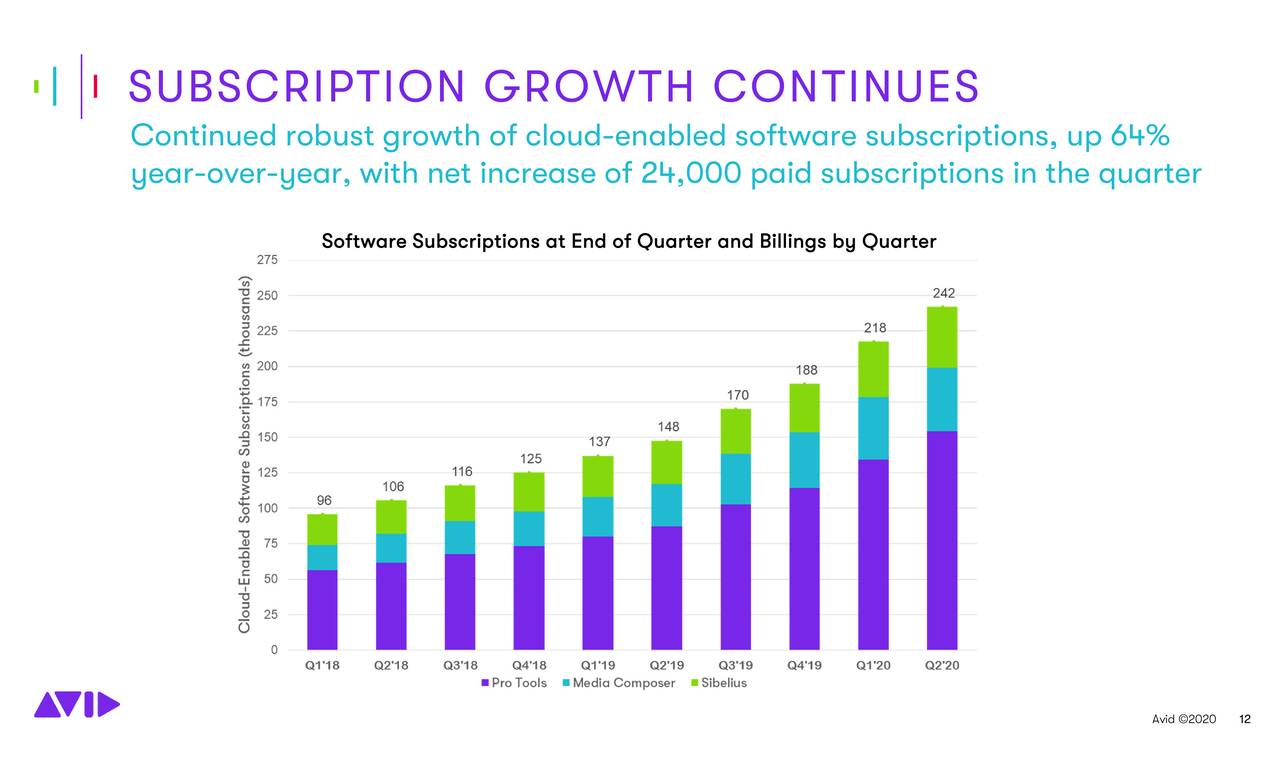

There is also good news from the margin front. Gross margin increased quite a bit (600bp to 65.4%), but part of that is inflated as a result of lower margin product sales declining by a lot while higher margin solutions kept on growing, and this can be expected to gradually right itself as the influence of the pandemic subsides.

However, it should not be overlooked that the company has also managed to significantly reduce COGS with the company on track to reduce these by $10M for the year.

GM for product sales contracted by 550bp to 25.8% (GM on software is 85.6%) so you wouldn't notice that, but this is of course because of the collapse in sales (-50%) as well as a mix shift in favor of lower margin audio products.

The company has been cutting OpEx quite ferociously, reducing these by $11.2M to $40.5M (y/y), consisting of the following:

- $6.6M from temporary furloughs and wage reductions

- $3M in travel reductions

- $3M in S&M reductions

More importantly, management believes that it can achieve a $30M OpEx savings this year while a full 60% or $18M of these cuts can be made permanent. That adds up for next year.

So we'll see both COGS and OpEx declines going forward, and this will be aided with the gradual recovery in product sales. It's already visible as adjusted EBITDA increased 43% y/y to $13.5M.

Risk

- Pandemic

- Productions

The impact of the pandemic is uneven and unpredictable and it is affecting Avid customers in a number of ways:

- Live events

- Production companies

- Ad market

This is what has been behind the slump in hardware sales (-50.1%) and also professional services & training (-33.4%) and management expects only a gradual and uneven recovery of these.

But there is of course the distinct risk that the pandemic will fester, or even worsen in main geographical areas important for the company.

On the other hand, it has to be said that the company has dealt with very well with these headwinds, which were really strong in Q2 and there might be some pent-up demand for products where and when the situation on the ground improves.

Q2 results

From the earnings deck:

From the earnings you wouldn't notice that their product sales slumped by 50% and their professional services by 33% as revenues beat expectations by 1.87M and non-GAAP EPS came in 14 cents better than expected at $0.12.

Outlook

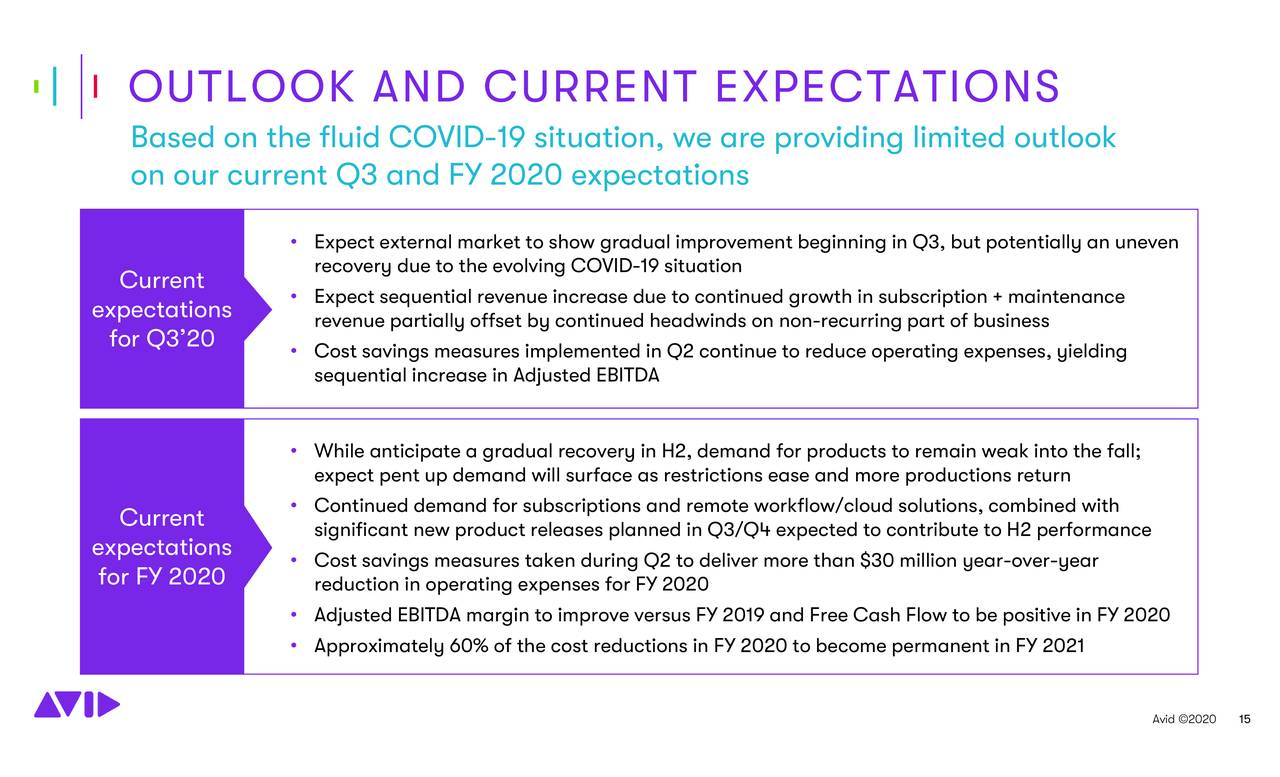

From the earnings deck:

Cash

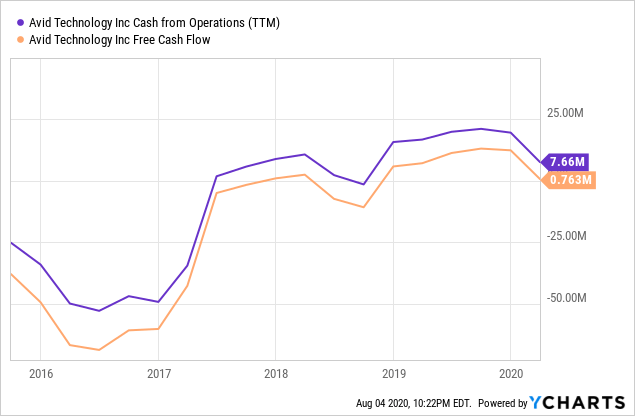

Data by YCharts

Data by YCharts

The graph above doesn't yet include Q2 results and although the headline figure was fairly bad (a free cash outflow of $5.2M), the situation is really a lot better than that figure suggests:

- Accounts payable were reduced by $21M y/y and by $17.1M sequentially (which enabled the company to get some discounts from suppliers which reduced COGS) although this was partly offset by a $7.1M reduction in accounts receivable and $2.9M reduction in inventories.

- The company repaid $29M in convertible notes

- The company received $7.8M in PPP loans

Management argues that this provides a strong foundation for rising free cash flow in H2, and that looks pretty sound.

The company has $55.7M in cash and equivalents and $230.7M in debt ($22M in a revolver and $119.7M in a term loan, both at a rather onerous LIBOR + 675).

Valuation

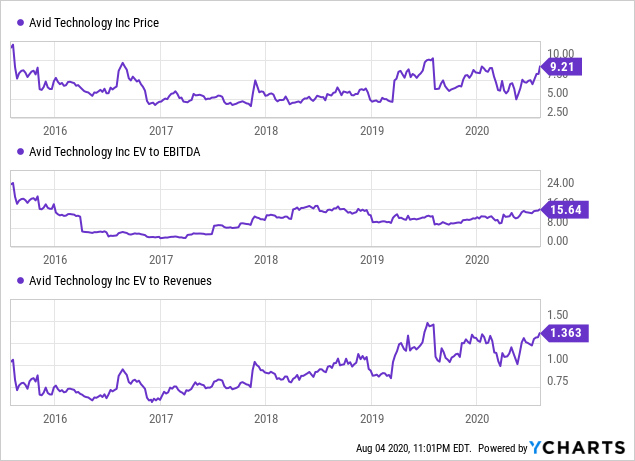

Data by YCharts

Data by YCharts

Valuation is really pretty modest, although one has to keep in mind the company has a considerable debt. Analyst see an EPS of $0.52 this year rising to $0.86 next year, which, if it plays out, is obviously too low.

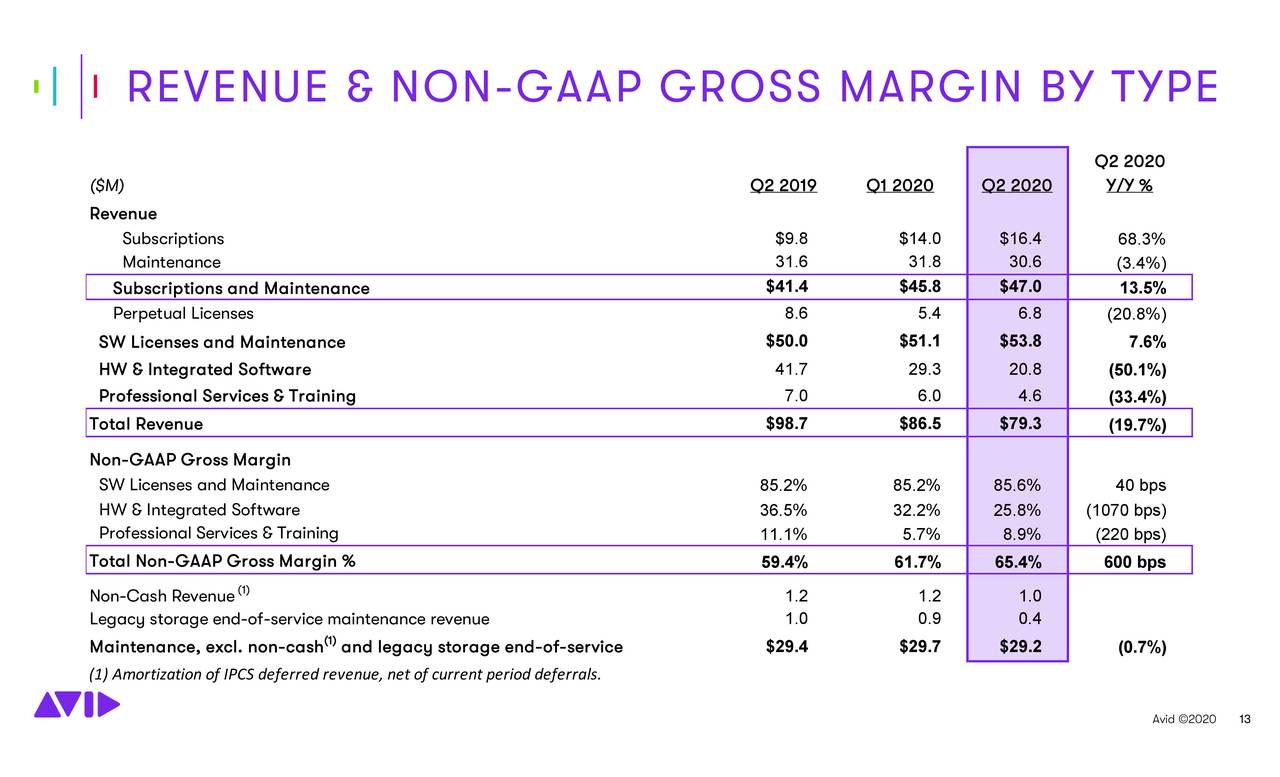

Insiders can't get enough

Particularly one insider, from FinViz:

Conclusion

Management has done a remarkable job in not only surviving, but thriving despite the pandemic and a 50% crash in hardware sales. Its platforms are thriving, accelerating the shift towards higher margins and recurring revenues, and management has aggressively cut cost.

We think the results are not sufficiently reflected in the share price and see considerable upside for the shares on lasting improvements.

If you are interested in similar small, high-growth potential stocks you could join us at our marketplace service SHU Growth Portfolio, where we maintain a portfolio and a wachtlist of similar stocks.

If you are interested in similar small, high-growth potential stocks you could join us at our marketplace service SHU Growth Portfolio, where we maintain a portfolio and a wachtlist of similar stocks.

We add real-time buy and sell signals on these, as well as other trading opportunities which we provide in our active chat community. We look at companies with a defensible competitive advantage and the opportunity and/or business models which have the potential to generate considerable operational leverage.