First Industrial Realty (NYSE:FR) is, as can be guessed by its company name, an industrial REIT. FR has churned out impressive financial results over the past several years, as it has benefitted from strong demand for industrial properties. Like many of its peers, FR appears to have struggled with the capital allocation as I do not share the same overly optimistic view regarding the future performance of industrial properties. FR's stock trades very richly, which suggests that FR should be preferring to issue stock instead of ramping up leverage to fund investments and acquisitions. I believe that historically rich stock price valuations should prove to be less stable than historically low interest rates in the long term.

Can't Stop Me Now

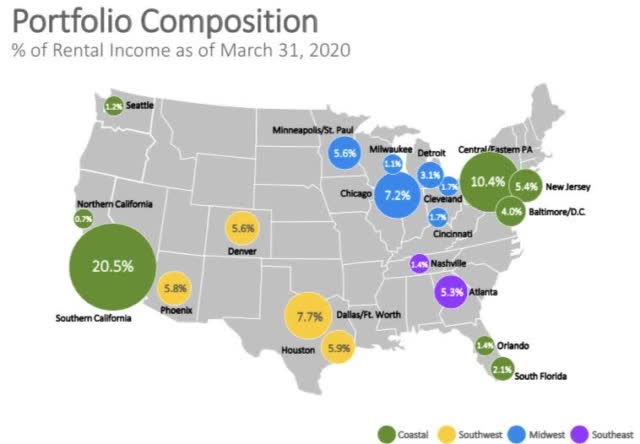

FR owns 445 industrial buildings spread across 15 states, with its largest presence in Southern California:

(Source: June Presentation)

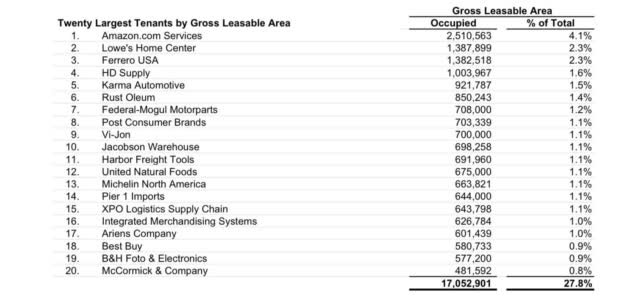

Amazon (AMZN) is FR's largest tenant at over 4% of GLA:

(Source: 2020 Q2 Supplemental)

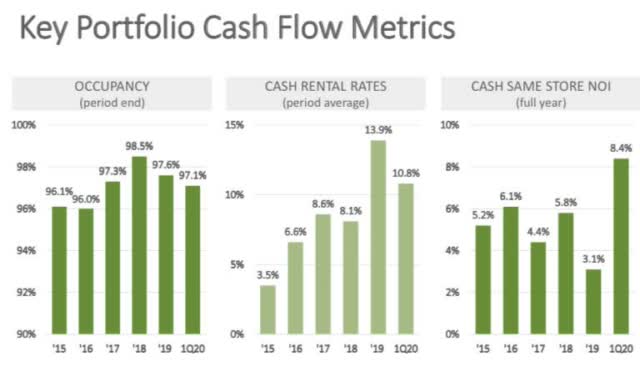

Like industrial REIT peers, FR has seen impressive growth over the past few years as the industry benefits from e-commerce tailwinds. FR has achieved outsized leasing spreads (compare the 8-13% spreads in recent years with the 3.5% seen in 2015) as well as outsized SS NOI growth:

(source: 2020 Q2 Supplemental)

If COVID-19 was supposed to slow down FR, it hasn't seemed that way.

FR collected 98% of second quarter rent and achieved 6.3% comparable NOI growth. FFO per share grew nearly 9% for the year. The main problem is that the bullish thesis for industrial REITs is so well known that these stocks have traded very richly which has raised the bar for what one should expect from them.

Observations About Portfolio Transformation

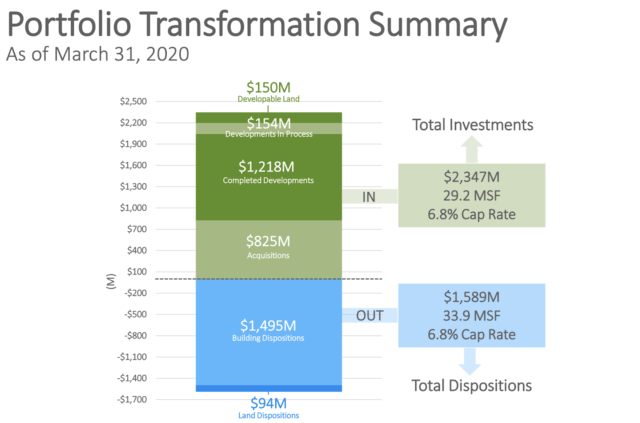

FR shows in its investor presentation the vast amount of capital recycling it has undertaken since 2010:

(Source: June Presentation)

If one were to look at the above slide right now, they might mistakenly think that FR is able to get rid of undesired properties at the same valuation as it is able to buy new properties. That would be very bullish. Recent transactions suggest otherwise.

FR saw a 7.2% cap rate on dispositions in 2019 and an 8.4% cap rate in 2020. FR's cap rate on acquisitions was 5.4% in 2019 and 5.6% in 2020. I point this out not to imply any degradation in portfolio quality but instead to emphasize that bullishness for industrial REITs is a well-known concept, and anyone who has invested long enough knows that the best investment returns rarely come from overcrowded trades. The problem is that FR, like many of its peers, seems to be in denial.

Admit It, Your Stock Is Overvalued

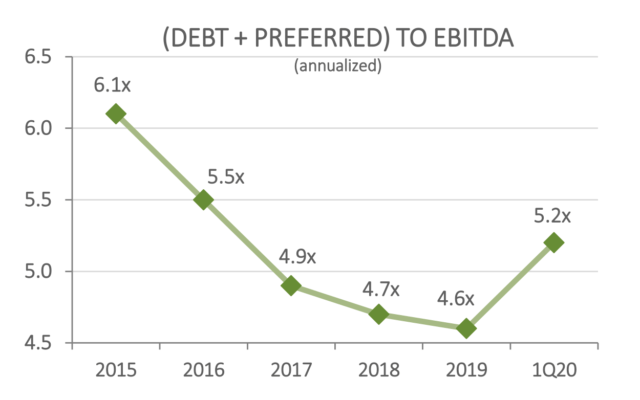

FR has minimal debt maturities until 2021 and a manageable leverage ratio. That said, it is precisely this area that spurns my disappointment.

Leverage has declined over the past couple of years, though FR brought up leverage this year:

(Source: 2020 Q2 Presentation)

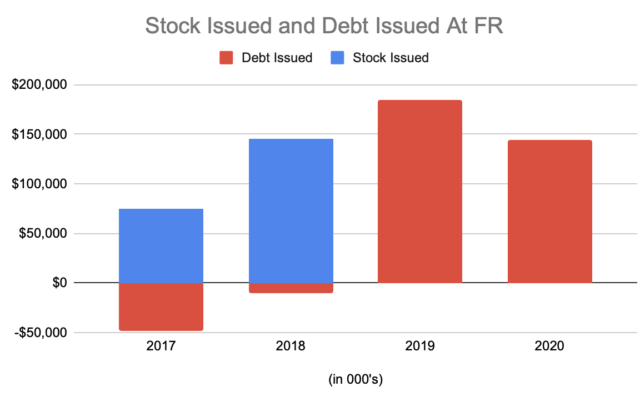

We can see that while FR was a net stock issuer and net debt repayer going through year-end 2018, it turned 180 degrees in 2019 when it ceased issuing stock and aimed to ramp up leverage.

(In 000s, Chart by Best of Breed, data from annual filings)

Was it the right decision to stop issuing stock and increase leverage? REIT investors know that REITs often utilize their own stock as currency for acquisitions and investments. REIT shareholders should want management teams that sell their stock when it's expensive, as such funding of acquisitions has the secondary benefit of strengthening the balance sheet. Unfortunately, FR has not been doing this in the past two years, in spite of a stock that arguably trades very richly.

FR is guiding for 2020 FFO of $1.80 per share at the midpoint. FR trades at roughly 23.9 times FFO. That's markedly lower than the 34 times at Prologis (PLD) and 43 times at Terreno (TRNO). FFO per share has grown at a 5.8% compounded annual rate since 2015. FFO, however, arguably overstates the value proposition because FR maintains a higher leverage ratio than peers, who have a debt to EBITDA in the ~4.0 times range. We should instead look at the cap rate.

FR has $336.5 million in stabilized annual NOI. With 129.9 million shares outstanding, the market cap stands around $5.6 billion, versus $1.855 billion in debt. FR thus trades at an implied cap rate of 4.5%. For reference, FR is guiding for comparable NOI to grow 3.75% in 2020, and SS NOI grew 3.1% in 2019. Comparing the 4.5% cap rate valuation to the NOI growth rate, it appears that excessive bullishness has pushed the stock price to a level that can only be sustained with equal or stronger results in the future than in the past. Can industrial REITs really maintain their strong financial growth rates moving forward? I argue to the contrary - as we saw above, cap rates on acquisitions have compressed dramatically, which means that growth through acquisitions will be much slower than in the past. This is also a good moment to mention the breaking news that mall giant Simon Property Group (SPG) is in discussions with Amazon to use its vacant department store space as fulfillment centers. Such a move would indicate increased supply nationally, which may slow down rent growth and drive cap rate expansion.

I would have preferred to see the FR management team acknowledge that the past financial strength cannot continue indefinitely, and thus choose to heavily rely on issuing richly valued stock to fund investments and acquisitions. FR's stock admittedly does not necessarily trade as richly as peers, but in its own respect it does not trade cheaply, and an 80% stock/20% debt split for external financing looks appropriate. If the good times end for industrial REITs, then the companies which have taken advantage of the rich stock price valuations of the last several years to reduce leverage will be well-positioned to take advantage, whereas the rest may find themselves in a pickle.

Conclusion

I anticipate that FR may appeal to many REIT investors if they were looking for a discount in the industrial REIT space, and they were forced to have industrial REIT exposure in their portfolio. That said, I am skeptical that the growth rates can continue moving forward and disappointed that FR has not been trying to aggressively reduce leverage in light of its rich stock price valuation. My top pick in the industrial REIT space continues to be Terreno Realty, as TRNO has shown a strong willingness to issue stock. Even then, the entire industrial REIT space appears very richly valued to me and not worthy of an investment at this time.

Buy Quality, But Don't Overpay

The average stock is expensive - should you pay up for quality or heighten the risk? Subscribe to Best of Breed to get access to my top 10 holdings and full access to the Best of Breed portfolio. Investing in Best of Breed has helped me rank in the top 1% of all investors on Seeking Alpha.