Alteryx (AYX) got downright obliterated last week, the stock collapsed by more than 28% on Friday after the company's earnings report was received with relentless selling by the market. The struggle is real, Alteryx is feeling the impact from the recession and the timing for recovery is unclear at this stage.

However, the slowdown is most probably transitory as opposed to permanent, and short-term weakness in a high-quality business seems to be creating a buying opportunity for investors in Alteryx.

Challenging Environment

Alteryx actually reported both sales and earnings numbers above Wall Street estimates during the second quarter of 2020. But forward guidance was clearly disappointing, and management did not provide many reasons to expect a recovery in demand in the short term.

It is important to understand that Alteryx provides software to make the data analysis process simpler, easier, and more efficient. This is not a company that benefits from specific work from home trends such as those in online communications or cloud computing. Alteryx offers a relatively expensive software solution in times when companies are cutting their spending as much as possible, and this obviously has a negative impact on revenue growth.

Nobody should be too surprised to see Alteryx suffering the impact from the recession, but management comments in the previous quarter may have provided a wrong impression because the company was not yet fully experiencing the deceleration in April.

In the words of Kevin Rubin, Alteryx's CFO:

Last quarter, we highlighted that new business activity in April was consistent with the levels in April, 2019. This gave us some degree of confidence that customers were reengaging after the abrupt slowdown we saw at the end of March. However, we have typical software linearity in our business, meaning the majority of our bookings are generally concentrated in the back half of the customer, changes

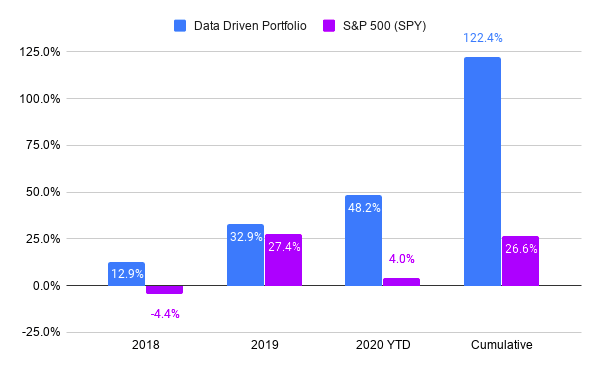

A subscription to The Data Driven Investor provides you with solid strategies to analyze the market environment, control portfolio risk, and select the best stocks and ETFs based on hard data. Our portfolios have outperformed the market by a considerable margin over time, and The Data Driven Investor has an average rating of 4.9 stars out of 5. Click here to get your free trial now, you have nothing to lose and a lot to win!

Performance as of August 9, 2020