This article was co-produced with Nicholas Ward.

Lately, we've been highlighting some of the safest areas of the REIT space - companies with reliable cash flows in today's volatile economy. As such, we've found ourselves focusing more than once on the multi-family rental space.

Apartment REITs, as a group, have performed relatively well with regard to rent collection throughout COVID-19. This is especially the case for the blue-chip names that focus on top-notch properties in areas of high demand.

For instance, we covered AvalonBay Communities (AVB) last week. Its second quarter earnings report reiterated our belief that it's worthy of ownership.

That's not to say we don't recognize where it's hurting. We're always about presenting the most accurate picture possible, complete with the good, the bad, and the ugly alike. As such, we noted that AVB's California portfolio was struggling, and how that was cause for concern for another high performer in the industry: Essex Property Trust (NYSE:ESS).

The company has built an empire over the years by focusing on supply-constrained markets on the West Coast. And since it also posted earnings last week, we thought we'd continue our multi-family coverage by reviewing Essex's most recent data too.

About Essex Property Trust

Essex is quite the unique play in the REIT space.

Unlike the vast majority of the REITs we track, it has deliberately avoided geographical diversification. Instead, the company focuses on select West Coast markets that have grown up around the tech boom.

Essex certainly isn't a technology company itself. But it has been a direct beneficiary of it, allowing the company to produce technology-like growth since its 1994 IPO.

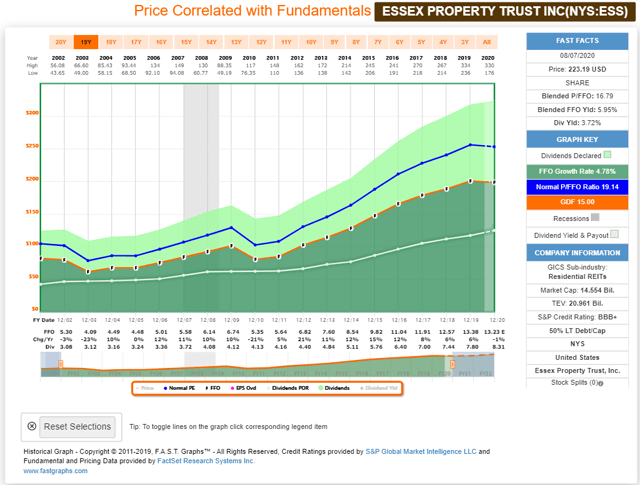

FAST Graphs: 2002-2020

We're talking about annualized total returns of roughly 17%. That's due, in large part, to management's foresight and willingness to invest heavily in real

We Can Help You "Put REITs in Retirement"

At iREIT, we're committed to assisting pre-retirees and retires navigate the REIT sector. As part of this commitment, we decided to provide our readers with a 20% discount to our service and we will also be included a copy of my book, The Intelligent REIT Investor. Don't miss out on the opportunity as we are limiting the 20% discount to our first 25 new members.

* Limited to first 25 new members * 2-week free trial * free REIT book *