Editor's note: Seeking Alpha is proud to welcome Alpha Apes as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Editor's note: Seeking Alpha is proud to welcome Alpha Apes as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

NCR Corp.: Optimistic on The Rebound, Cautious of the Future

Despite being part of the notoriously resilient Technology Hardware, Storage & Peripherals industry, NCR Corporation (NCR) has yet to recover from the equity sell-off of early March, mainly by its nature of major dependence on the retail sector's clients. Working through the company's latest briefings as well as reports from peers, we believe that a combination of resilience and innovation in younger comps mixed with the grim outlooks from reportable segments are the causes of this softened valuation.

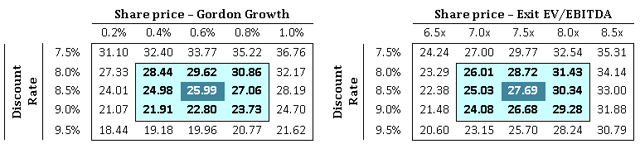

That said, NCR stagnation at 7x P/E proves to be an attractive entry point. With the potential to capitalize on certain post-pandemic banking and retail trends, seasoned management, strong liquidity, and a sustainable business model, we find that the company is trading at a discount of 34.22% and the price target of $27.69, reconciling from our unlevered Discounted Cash Flow model. Here, we are bullish of the name in the short term with an investment horizon of 1-2 years.

Source: Our Discounted Cash Flow Analysis

Company Overview:

NCR is a leading maker of ATMs, point-of-sale (POS) terminals, and self-checkout (SCO) terminals - including its barcode scanners, and related printer consumables such as paper and ink. Since 2015, the company has seen a shift in management due to the involvement with Blackstone, recruiting