In spite of the restrictions imposed to fight the COVID-19 pandemic in the mining sector, Centamin (OTCPK:CELTF) has already produced 256K ounces of gold in the first half.

This represents a 9% increase compared to H1-2019 and the executives are cautiously optimistic that the miner is on track to meet its annual production target of 510K to 525K ounces of gold from the Sukari mine in Egypt.

Figure 1: Sukari gold mine

Source: Centamin.com

This mining play has paid all its debt and operates in a country relatively unknown for its gold production and therefore with less competition for concessions and plenty of labor.

This means relatively lower costs and that there is significant potential for growth as I depict by providing an overview of the mining sector.

The Egyptian mining sector

The country has fairly rich subsoil, harboring immense mineral resources, but the mining sector still contributes little to the economy.

Egypt's Eastern Desert alone is estimated at holding gold reserves higher than 300 tons.

However, Egypt has not been able to develop its mining potential despite rising commodity prices due a lack of effective measures to attract investors.

This state of affairs appears to be changing as the Egyptian government wants to increase the share of the mining sector to 2% of GDP compared to 1% presently.

In this context, Egyptian mining authorities began auctioning 56,000 square kilometers of exploration concessions early this year.

Interestingly, Centamin which has been present in Egypt for the last eleven years was until February 2020 the only international company with a mining license in Egypt.

The second company is Canadian based Anton Resources (OTCPK:ANLBF) which is still exploring for gold.

According to mining.com, Centamin's new CEO, Martin Horgan has indicated that his company would participate in the auctions.

With years of experience extracting gold in the Egyptian desert and the financial world hungry for the yellow metal, this could bolster the revenue and financial position of the company to a much higher level.

Current income and financial position

With gold prices rising and production on track, Centamin benefited from a revenue increase of 56% at $449 million for the first half of 2020 compared to H1-2019 with sale averaging $1,657 per ounce as at June 30.

Adjusted free cash flow was $102 million after $101 million was disbursed in terms of profit sharing and royalties to the Egyptian state.

Net profit attributable to shareholders was $75 million.

Figure 2: Statement of income

Source: Centamin.com

Most importantly, Centamin has paid back its debts and cash stood at $367 million as at June 30.

CapEX was $52 million, less than budgeted due to referral of non-essential spends due to COVID-19 and the extra amount left should normally be consumed in the second half of the year or even in 2021.

As for dividend, Centamin declared a second interim dividend of 6¢ ($0.06) per share to be paid in September 2020. For that matter, the first interim dividend paid in May 2020 was also of 6¢ and amounted to $69 million.

Also dividend payout ratio is 32.34%.

Figure 3: Statement of financial position

Source: Centamin.com

Now, especially for new investors, mineral production in most developing countries is still carried out through contractual arrangements between foreign firms and the host country's government.

Deeply embedded in these contracts are profit-sharing agreements which should not be ignored and are the subject of my focus next.

Possible challenges

One area where there has been a change pertains to the terms of the concession agreement with EMRA, Centamin's Egyptian partners.

In this respect, on July 1st, 2020, the profit share mechanism changed to 50:50, from 55:45 in favor of Centamin and will remain at this level for the remainder of the tenure.

A rough yearly estimate using the latest income figures indicates that this amounts to $10 million.

Figure 4: Sukari concession agreement

Source: Centamin.com

Second, gold production levels for Q3-2020 may not be that elevated.

In this respect, the exceptionally high levels of output of the second quarter were mostly due to higher mill feed grades and the deferral of plant maintenance shutdowns to the third quarter.

The latter deferral was done as a proactive step to limit third-party contractors to the production site in order to reduce coronavirus infection possibility.

Also, while there was no material impact from COVID-19, the company still had to incur additional costs of $5.7 million due to the pandemic as at June 2020.

Digging deeper into COVID infection in Egypt, according to some news sources, cases have been dropping since end of July.

Continuing on a positive note, gold prices are sky-rocketing. From $1,657 per ounce during the first half, at the time of writing of this article, the price had already reached $2,034, which is a 22% increase.

This increase should partly offset shortfalls due to a decrease in profit by 5% and reduced revenues as a result of falling mining output.

I have another reason to be optimistic on Centamin and this relates to production costs.

While, Centamin is not among the first ten global lowest gold miners, it must not be far with that cash cost of production of $655 (mid-point of $630 to $680) per ounce targeted for FY2020 compared with $715 per ounce for Yamana Gold (AUY), a Canadian miner.

Using the latter as a comparison, I now provide an indication of the valuations.

Valuations

First, the Canadian miner has a market cap of $6 billion and therefore more scale compared to Centamin at a market valuation of only $3.32 billion.

However, Yamana suffered from a temporary suspension of operations during the period from March to April which has not been the case with Centamin.

Figure 5: Comparing Centamin and Yamana in terms of valuation metrics.

Source: SeekingAlpha

Also, from the wider perspective and in the context of COVID-19, miners like Yamana face short term challenges to control operations spanning across various countries each with different social distancing and confinement measures.

This is the reason I prefer smaller and more agile plays like Centamin.

Furthermore, taking into consideration EV/Sales and EV/EBITDA metrics, the stock price of the smaller miner should be higher.

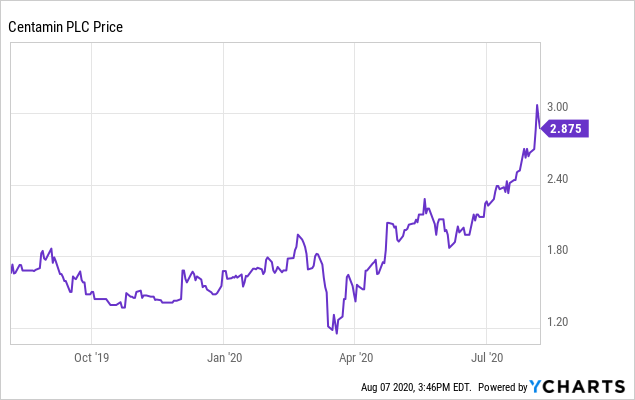

Hence, I target a price range of $3.20 - 3.50.

To this end, investors will note that I have also realistically moderated the target taking into consideration the challenges.

Figure 6: Share price evolution showing latest volatility

Data by

Data byKey takeaways

This higher valuation is supported by further growth opportunities in Egypt.

Here, Centamin as the incumbent has a leading role to play in increasing gold's portion in the gross domestic product of the country.

In this context, some may remember that Centamin was subject to a hostile takeover bid by Endeavour Mining, a company active on various gold projects in West Africa at the end of last year.

Hence, I see a merger with an international mining company keen on taking advantage of the Egyptian subsoil even before the coronavirus dust settles as still being on the cards.

Therefore, there is significant growth potential for Centamin, either through organic growth by exploiting more concessions or through M&A activities resulting in higher EPS and therefore decreasing that P/E ratio.

This is the reason for which I purposely ignored the trailing P/E ratio as a valuation metric in this case, in order not to be limited.

Consequently, my rationale for being bullish and targeting more than 20% upside is not uniquely based on the price of gold.

Equally important, I view the company's control of production costs as key to mitigate against downwards movement of gold prices.

Furthermore, Centamin has a first-mover advantage in a high-growth environment with relatively less competition.

To complement this position of strength, the management has an in-depth knowledge of Egyptian bureaucracy.

Finally, for those who are apprehensive about possible disturbance affecting production, I checked and found that Centamin maintained output levels in September of 2019 when Egypt was amid protests and riots.

On a more positive note, according to mining.com, the new concession rules do not include the joint venture clause (need for foreign company to partner with the Egyptian government) and limits state royalties to a maximum of 20%.

Therefore, Centamin with a current stock price of $2.60 and a dividend yield of 4.5% based on a total distribution of $0.12 is a buy.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.