REITs (VNQ) are gaining a lot of attention right now.

On one hand, you have contrarian investors who are very bullish on REITs because they trade at near their lowest valuation in 10 years even as interest rates have hit 0%.

On the other hand, you have more skeptical investors who remain bearish due to missed rent payments, defaulting tenants and the risk of permanent changes to how we use real estate.

It's a very polarized market with a wide range of opinions.

What's our view at High Yield Landlord?

We are very bullish.

We think that inexperienced investors who think that this crisis will permanently damage the REIT sector should go read some history.

In today’s article, we will bring this history to you. Here are five lessons on REIT history that should serve as an important warning to all the naysayers.

Lesson #1: Buying REITs After a Crash Has Always Paid Off

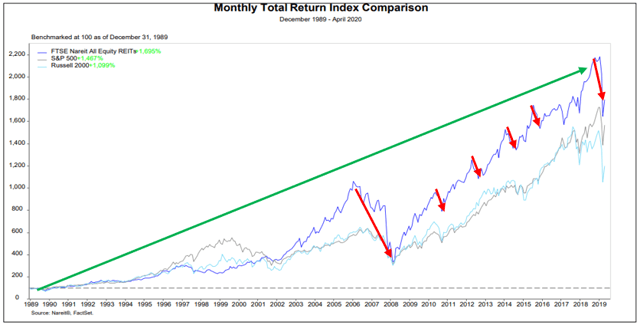

REITs have existed since the 1960s and gone through many crises and bear markets in the past. Yet, they always fully recovered, without exception:

Some of these past crises were much worse for REITs than the current one. As an example, in 2008-2009, REITs went into the sharpest real estate crash ever recorded with overleveraged balance sheets, and suddenly, banks stopped working and it was impossible to refinance debt.

It put the entire sector at risk of bankruptcies and forced many REITs to cut dividends and raise equity at highly-dilutive prices.

This was a perfect storm and it certainly was much more dangerous for REITs than the current crisis. Yet, REITs nearly tripled in just two years following the crisis and investors who had the courage to invest made a fortune.

REITs today enjoy the strongest balance sheets in their entire history, banks are working, and REITs

What Else Are We Buying?

We are sharing all our Top Ideas with the 2,000 members of High Yield Landlord. And you can get access to all of them for free with our 2-week free trial! We are the #1 ranked real estate investment service on Seeking Alpha with over 2,000 members on board and a perfect 5 star rating!

You will get instant access to all our Top Picks, 3 Model Portfolios, Course to REIT investing, Tracking tools, and much more.

We are offering a Limited-Time 28% discount for new members!

Get Started Today!