Thesis

Equity REIT stock prices have approached pre-covid levels for many companies. However, REITs in the most affected sectors have seen their stock prices remain low. Whether stocks in the retail, hotel, and office sectors can return to pre-pandemic levels will largely be dependent on rent collections, rental rates, occupancy rates, and leasing volume levels. Preferred stock, a hybrid equity and debt investment, opportunities in the REIT space exist. Cedar Realty Trust and Medalist Diversified REIT have preferred shares trading at large discounts, as their properties face headwinds due to covid. Manufactured Housing Properties has continued to perform strong throughout the pandemic, but has an attractive, non-traded preferred stock return potential as well.

Cedar Realty Trust

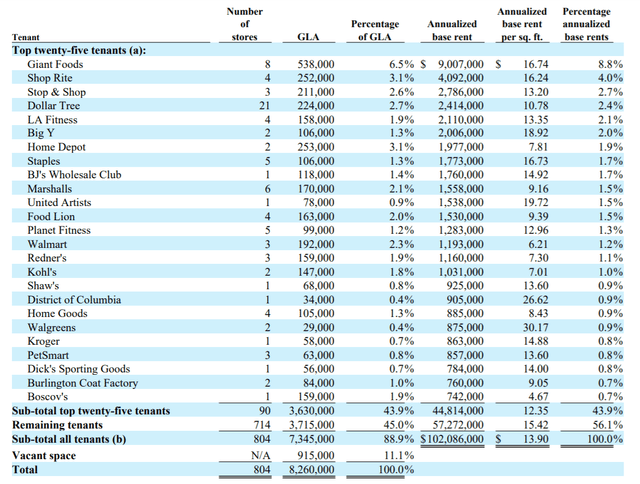

Cedar owns a portfolio consisting of predominately grocery-anchored shopping centers that consists of e-commerce resistant tenants.

CDR collected 77% of 2nd Quarter rents, and rent collection rates have increased to 88% for July. These results have surpassed their peers. July rent collection for many publicly-traded shopping center REITs remained below 80%. Despite having lower than average rental rates per square foot, Cedar’s grocery-anchored portfolio has held up strong throughout the pandemic. With rising retail bankruptcies, covid will have a negative short-term impact on CDR. However, Cedar’s well-positioned portfolio and adequate financial results make its preferred shares a low risk, high return investment opportunity.

| Company | July Rent collection levels |

| CDR | 88% |

| REG | 79% |

| BRX | 80% |

| ROIC | 85% |

| WRI | 79% (June) |

Source- Quarterly Reports

Cedar’s series C shares offer an 8.5% annual dividend yield at current prices, with the potential for more than 30% appreciation in price.

| Ticker | Price | Div rate | Current yield | Liquidation value | Potential appreciation |

| CDR.PC | 19.14 | 1.63 | 8.5% | 25 | 30.6% |

| CDR.PB | 22.2 | 1.81 | 8.2% | 25 | 12.6% |

The risk to Cedar’s preferred dividends is extremely