Magnite (NASDAQ:MGNI) is a relatively small company with enormous opportunities for growth in programmatic advertising over the years ahead. The company is facing considerable challenges, and a position in Magnite is inherently risky. Nevertheless, the upside potential may be well worth it.

Solid Performance In A Challenging Period

Magnite is the largest independent sell-side omnichannel advertising platform in the world. The company is the result of a merger between Rubicon Project and Telaria; this merger is quite recent, as it was completed in April of 2020.

Rubicon brings a large presence as a scaled programmatic exchange to the table, while Telaria provides leading connected TV (CTV) capabilities, so the merger makes a lot of sense from a business perspective.

Scale and presence are key sources of competitive strength in the sector, and Magnite is very well positioned in that regard. The company has access to over 2,000 publishers in 50 countries, with over 150 billion daily impressions and more than 600 employees globally.

On the other hand, things are not easy for Magnite nowadays. Advertising is a very cyclical industry, so the recession is a major setback for the whole sector. Besides, implementing such a merger in times of work from home and rampant uncertainty can be a colossal challenge.

But Magnite still delivered better-than-expected numbers for the second quarter of 2020. Reported revenue increased 12% year over year to $42.3 million, the number surpassed analysts' expectations by $4.7 million.

Even more important, management highlighted some very positive trends in revenue during the quarter.

Since our last earnings call, we have observed a steadily improving revenue recovery. We noted in our last earnings call that we had observed revenue stabilizing in April and early May at a level of roughly down 30% year-over-year on a pro forma basis. Revenue in May and June continued

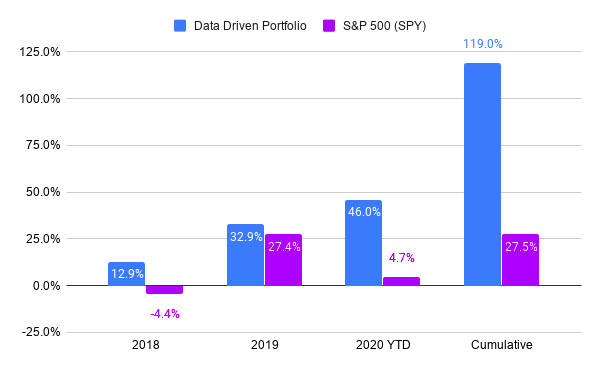

A subscription to The Data Driven Investor provides you with solid strategies to analyze the market environment, control portfolio risk, and select the best stocks and ETFs based on hard data. Our portfolios have outperformed the market by a considerable margin over time, and The Data Driven Investor has an average rating of 4.9 stars out of 5. Click here to get your free trial now, you have nothing to lose and a lot to win!

Performance as of August 16, 2020