Please recall the most recent article depicting Global Self Storage (NASDAQ:SELF): "Unlocking Shareholder Value at Global Self Storage." Therein, a NAV of $6.99 for SELF was calculated as of 3/31/2020.

Finding the NAV on 6/30/2020

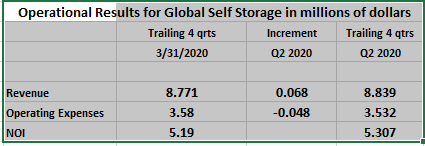

Please see Exhibit One below. The first column represents the trailing four quarters' operating results as of 3/31/2020, tabulated in the above article. The increment column subtracts out corresponding values for Q2 of 2019 and adds back the same for Q2 of 2020. The final column shows the adjusted trailing four quarters as of 6/30/2020. The increment column is easily derived from the latest Q2 Report of SELF. Therein is reported a $68,024 increase in property-related revenues over Q2 in 2019 with a simultaneous decrease of $48,320 in operating expenses.

Exhibit One

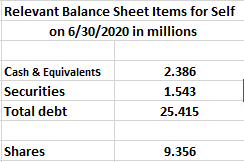

Exhibit Two (taken from the same link as above) gives us selected balance sheet information as of 6/30/2020

Exhibit Two

Using the same market cap rate of 6 %, as in the previous article cited above, we compute the total market value of the properties to be: 5.307/0.06 = $88.45 million. Adding back liquid securities and subtracting out total debt renders a value of $66.964 million attributable to the 9.356 million shares, or $7.16 per share as of 6/30/2020.

The Annualized Economic Return for Global Self Storage Shareholders

Please see the Q2 Corporate Presentation. There we learn that the shareholders benefited from $545,000 in AFFO, or $0.058 per share. In addition, the shareholders enjoyed an implied market value appreciation of their underlying properties of $7.16 - $6.99 = $ 0.17. The total quarterly true underlying economic return is estimated as $0.228 per share. At the closing price of $3.83 on 8/7/2020, this represents a quarterly economic ROE of 5.95%, or a robust 23.8% annualized!

Note that this was computed by omitting restricted cash, accounts