Last August, I published an article on Lululemon (NASDAQ:LULU), highlighting its unique position to take on the sports apparel sector. Since then, shares have doubled, marking one of my more successful bullish theses. Over this past year, there have been some positive advancements made, adding to the company's growth story.

However, the stock's rally has not matched the company's underlying financial progress. At its current price of $353, I believe that shares are priced with unrealistic expectations in mind, offering little future expected returns, with virtually no margin of safety.

Source: Google Finance

In this article, I will:

- Go through Lululemon's financial progress

- Explain why its current valuation limits shareholder returns

- Mention a couple of additional risks

- Conclude why shares are not worth buying at their current price levels

Source: Lululemon

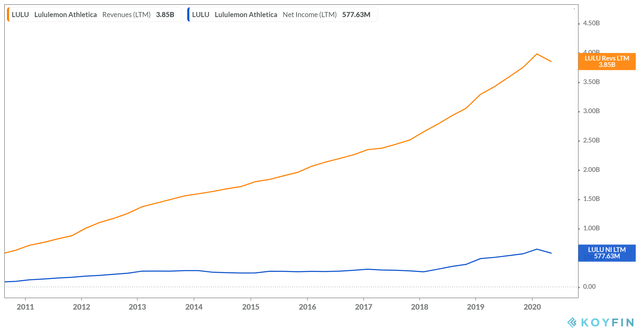

Financials and business progress

Over the past 12 months, Lululemon has continued its decent growth, despite the challenges caused by COVID-19. Further, profitability has remained stable, despite many companies in the sector suffering temporary losses (e.g., Nike (NKE), Under Armour (UA)). Lululemon's profitability has always been its strong feature, and the reason why I believed the company makes for a good investment in the first place, last year.

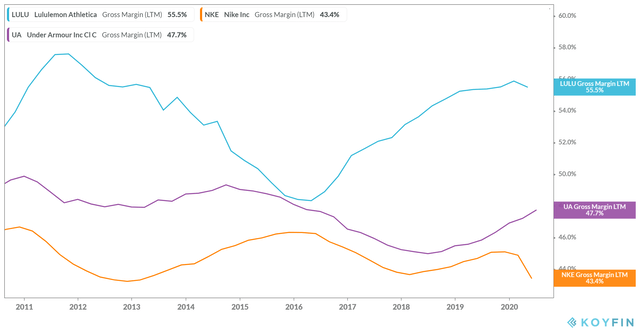

The company has been able to achieve superior profitability levels in the sports apparel sector, due to its luxury-branded products that appeal to the higher-end consumers, with premium pricing attached. For context, their women's leggings, which is the company's flagship product, start at $60 post-discount, with an average price point at around $100. As a result, Lululemon can achieve more prominent gross margins, compared to its competitors.

The company has been able to achieve superior profitability levels in the sports apparel sector, due to its luxury-branded products that appeal to the higher-end consumers, with premium pricing attached. For context, their women's leggings, which is the company's flagship product, start at $60 post-discount, with an average price point at around $100. As a result, Lululemon can achieve more prominent gross margins, compared to its competitors.

While revenues took a step back in Q1, declining by 16.7% YoY, e-commerce revenue rose by 68% YoY to $352M to account for 54% of sales. In my view, this is probably the most significant metric in the whole report, and