So much for a "turnaround earnings season."

TJX Companies (NYSE:TJX) delivered second-quarter results that, to be fair, landed above analysts' and the management team's expectations. Revenue decline of nearly 32% looked bad, but not as much as it had been projected prior to earnings day. Considering that TJX's stores, online channel and distribution centers were closed for roughly one-third of the quarter, sales seemed decent enough for as long as stores remained open.

However, shares sold off on earnings day, dropping another 5% and settling 15% below February highs. Bearishness can be explained by the somber tone around the third-quarter recovery. It looks like even off-price players will not avoid a slow and painful climb from the depths of the COVID-19 crisis across the retail space.

Credit: QNS

On the numbers

Top-line performance was very clearly divided between home products on one side of the fence, everything else on the other. Case in point, open-store comps at the Home Goods banner looked very robust at 20%, reflecting consumers' changing habits: more time spent at home than outside, in the office or at school. At Marmaxx, for example, open-store comps were -6%, with probably most of the underlying upside coming from home categories that partially offset weakness elsewhere in softline.

A gross margin decline of nearly six percentage points looked oversized, in my opinion. Considering how little TJX relies on the more costly e-commerce channel, I imagine that most of the margin pressure must have come from loss of scale and aggressive discounting. The latter would also help to explain how TJX managed to unwind its inventory as quickly as it did: by nearly one-fourth in a mere three months.

Regarding the third quarter, management delivered what I believe to be a mixed message. On one hand, the executive team seemed

Beating the market by a mile

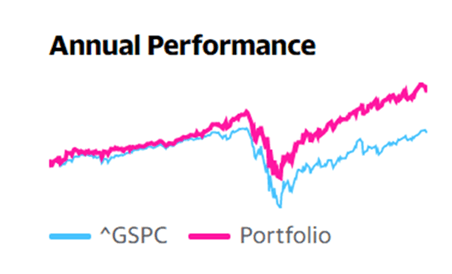

TJX is only a piece of my All-Equities Storm-Resistant Growth portfolio. Other mega-cap names have produced a much larger portion of the gains, which have been better than the S&P 500 by a mile (see graph below, pink line).

To learn more about the storm-resistant growth approach to investing, I invite you to join our community. Click here and take advantage of the 14-day free trial today. After that, don't forget to join the Live Chat so we can share a few thoughts.