Alteryx (AYX) recently reported earnings and the market reaction was distinctly unhappy.

While the reported results were generally acceptable, it was the guidance that triggered the violent market reaction, with the stock price promptly selling off more than 35%.

Earnings Snapshot

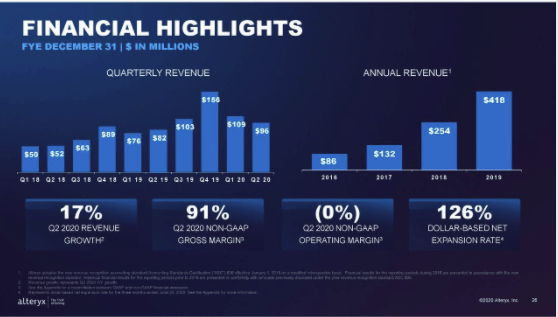

Alteryx reported relatively good revenue growth in the circumstances. Q2 revenue increased some 17% year over year, noticeably slower than growth in Q1 and the rate of growth that Alteryx had seen throughout most of 2020.

What was of particular concern to investors was the guidance provided by Alteryx, not only for Q3, but through the end of the year. Alteryx indicated that Q3 revenue was likely to be in the range of $111M-115M which suggested a year-on-year revenue increase of a little over 10%.

Further, full-year 2020 revenue guidance was for a range of $460M-465M. This would actually imply Q4 revenue of approximately $145M, suggesting a revenue decline from the $156M that Alteryx delivered in Q4 of 2019.

Investors seemed to take away from Alteryx's result that not only is the situation for Alteryx not improving, but that it may actually be getting worse. I would suggest that the situation looks a lot worse than what it seems. Looking beneath the surface the issues that are plaguing Alteryx appear to me to be short term in nature and largely timing-related.

I wasn’t one to sit and lament the collapsing price and was happy to add to my existing holding recently. Here are the 4 reasons why I bought the dip.

The Data Problem Hasn't Gone Away

The data tsunami problem which Alteryx so effectively solves for hasn’t miraculously gone away because we are in a pandemic and because customer wallets are tight. Data analysts across the Fortune 2000 are still confronted with the problem of how to best prepare

If you are interested in uncovering other sustainable high growth prospects, please consider a Free Trial of Sustainable Growth. Prices will increase to $349 yearly at the end of August. Lock in your discounted rate!

- Methodology based on the publicly tracked Project $1M, which has doubled S&P 500 returns over the last 4 years, delivering 23% annualized.

- Access to Large Cap, Emerging Leader, Venture, and High Conviction Model Portfolio which outperformed the S&P 500 in 2019 and 2020 YTD.

- Dynamic, engaged chat room with other like-minded investors.

- Exclusive ideas on potential 'Wealth Creators of tomorrow.'