This article first appeared on Trend Investing on July 21, 2020; therefore all data is as of this date.

Turquoise Hill Resources [TSX:TRQ] (NYSE:TRQ) is a Canadian company that owns 66% of the massive Oyu Tolgoi copper-gold-silver mine in Mongolia. The mine is of world class size and good grades, but has a high CapEx to develop the underground portion. The Oyu Tolgoi Mine began construction in 2010 and shipped its first batch of copper on 9 July 2013.

Rio Tinto (RIO) indirectly controls the mine through its majority interest (51%) in Turquoise Hill Resources, with the Mongolian Government owning the remaining 34%.

Turquoise Hill Resources Oyu Tolgoi copper-gold-silver mine in Mongolia

Source: www.turquoisehill.com/

Turquoise Hill Resources price chart (US listing) - Price = CAD 1.17, USD 0.86

The long term price chart below shows Turquoise Hill Resources is highly correlated to copper prices. The stock peaked above USD 20 per share back at the last copper price peak of USD 4.50 in late 2010/early 2011 during the post-GFC recovery.

Source: Yahoo Finance

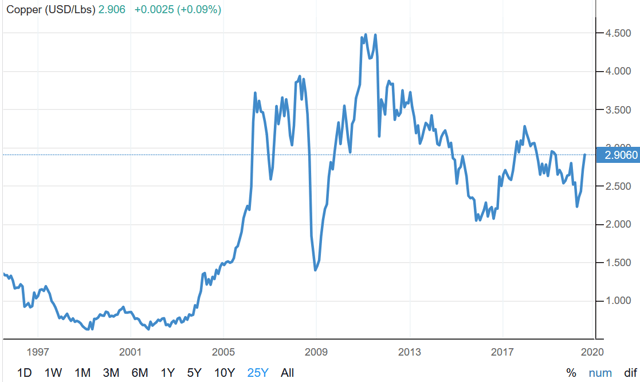

Copper 25 year price chart - Price = USD 2.90 today

Copper prices have recently started to recover as China has started to recover post COVID-19. Longer term the copper demand story is very strong boosted by the new green economy of renewable energy and electric vehicles (including charging stations).

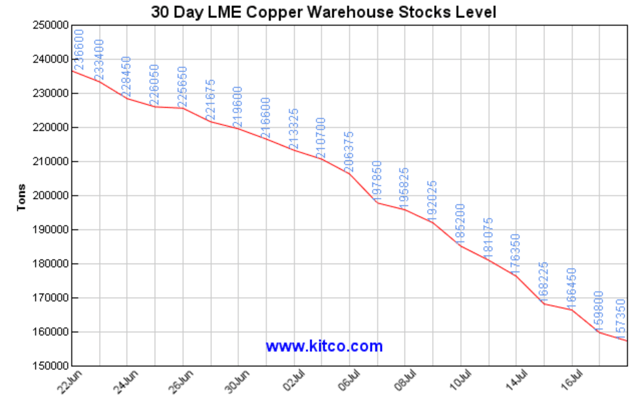

LME Copper inventory is quite low at 151,075 tonnes and declining lately.

Source: Trading Economics

Source: Kitco

Source: Trading Economics

Turquoise Hill Resources Oyu Tolgoi Mine (66% owned)

Turquoise Hill Resources owns 66% of the world class Oyu Tolgoi copper-gold-silver mine in Mongolia. It is an established open pit mine currently generating steady cashflow, with an underground development well advanced and expected to generate material cash flow. Being in Southern Mongolia the mine is close to its main customers in China.

Trend Investing

Thanks for reading the article. If you want to sign up for Trend Investing for my best investing ideas, latest trends, exclusive CEO interviews, chat room access to me, and to other sophisticated investors. You can benefit from the work I've done, especially in the electric vehicle and EV metals sector. You can learn more by reading "The Trend Investing Difference", "Subscriber Feedback On Trend Investing", or sign up here.

Latest articles: