Written by Robert Kovacs

Introduction

There are some stocks which get no love on Seeking Alpha. I guess it is quite normal. The big names are quite the draw. I must say, I myself am a victim of this. I follow up on my investments in large companies like IBM (IBM), Altria (MO), or AT&T (T), a lot more than I do on some of my mid cap dividend stocks.

Yet, it is often when nobody is looking that one can find the best ideas. I believe this is the case of Cogent Communications (NASDAQ:CCOI).

Cogent is a company which has received no coverage on Seeking Alpha, except for my two articles.

I picked up a small position on the fly in September, as the dividend seemed somewhat safe, and the potential was explosive. By February, the price had increased by 20%, I decided against adding to the position. I would just let my small position run. I was quite concerned with the price. Clearly the market wasn’t. Cogent soared another 25% and reached $90 by late July. Then the company missed earnings and revenue estimates, and the price dropped. It dropped big time

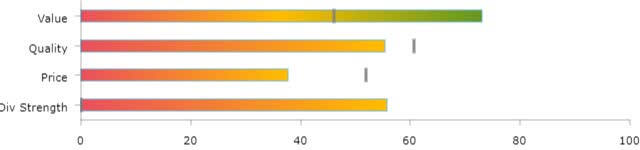

CCOI is currently trading at $67.01 and yields 4.06%. Our MAD Scores give CCOI a Dividend Strength score of 56 and a Stock Strength score of 61.

I am now increasing my stake in Cogent, as having reviewed its business model, and growth prospects, I believe it is underappreciated.

Source: mad-dividends.com

The company engages in the provision of internet access, through its fiber optic network. CCOI operates over 58,000 miles of intercity fiber routes and over 36,400 metro miles.

Fiber is very much an infrastructure business. It is quite competitive, with Cogent running only the 9th largest network, behind behemoths like AT&T, Verizon (