Welcome to the nickel miners news for August. The past month saw nickel prices rise significantly and legendary mining investor Robert Friedland stating: "The new oil is copper, nickel, cobalt." This follows last month's plea from Tesla's (TSLA) Elon Musk for mining companies: "Please mine more nickel."

As the 2020 is rapidly becoming the decade of renewable energy and EVs, it seems the world may be finally realizing to achieve a better future we need to invest in and support the miners. Or at least the realization that we will soon have shortages of key critical metals especially as EV and solar/wind demand surges. This month Forbes summarized it well saying: "America's clean energy transition demands a mining boom."

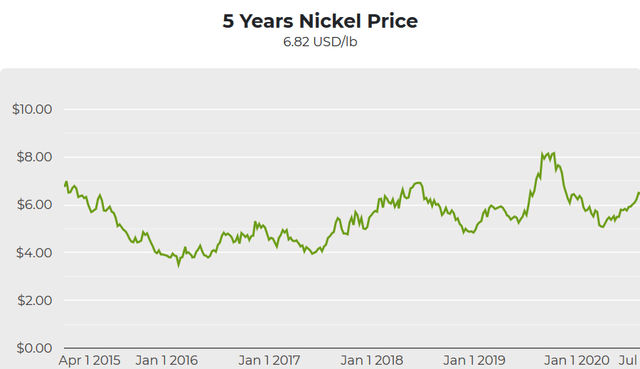

Nickel price news

As of August 27, the nickel spot price was USD 6.82, up from USD 6.22 last month. Nickel inventory at the London Metals Exchange (LME) was slightly higher than last month at 238,830 tonnes (234,852 tonnes last month).

Nickel spot prices - five-year chart - USD 6.82/lb

Source: Mining.com

On July 30 Investing News reported:

Nickel Price Update: H1 2020 in review. The recent call for more nickel mining from Tesla's Elon Musk suggests that the base metal's future in batteries for electric cars continues to be bright - but in the short-term stainless steel will be the main driver of the market. CRU Group's Nikhil Shah also told INN that the surprise has been how quickly the rebound in prices happened given nickel's fundamentals. "I think that is a concern, given that fundamentally we look at the market being in surplus this year," he said. "There's potential for nickel prices to correct from current levels in the second half of the year"..... Roskill Senior Analyst Jack Anderson told INN. "We anticipate the price to improve a little through H2 2020, supported by a partial demand recovery, especially in China."......"The incredible

Trend Investing

Thanks for reading the article. If you want to sign up for Trend Investing for my best investing ideas, latest trends, exclusive CEO interviews, chat room access to me, and to other sophisticated investors with a focus on renewable energy & the EV and EV metals sector. You can learn more by reading "The Trend Investing Difference", "Subscriber Feedback On Trend Investing", or sign up here.

Latest articles: