Investment Thesis

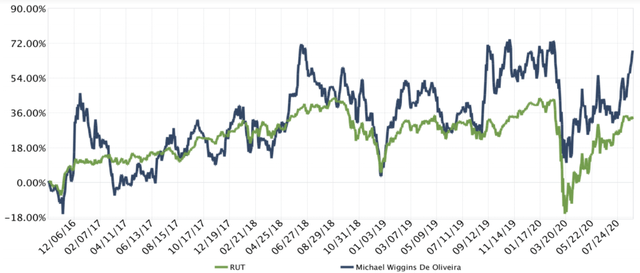

Agora (NASDAQ:API) is a very rapidly growing video platform. It benefited from a COVID spike, but looking ahead it's still guiding for a very respectable growth rate in the mid to high 50% range.

Although the stock trades at 42x forward sales, it is already generating a small amount of free cash flow.

Also, given its very high net expansion rate of approximately 130% expected in H2 2020, this stock is actually cheaper than it first appears on the surface.

Agora's Highly Compelling Video Platform; Not Zoom

Agora is different from Zoom (ZM).

Zoom continues to grow at such a fast pace which only solidifies the bullish thesis that there is a huge demand for video as a medium of communication. Zoom is so powerful that it's now a household 'verb'.

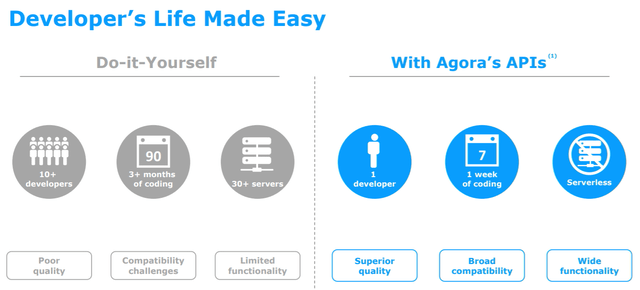

However, Agora is different from Zoom. Zoom is its own platform. The difference with Agora is that gets embedded in user's platform. In fact, one notable difference is that with Agora there is no need to switch between apps.

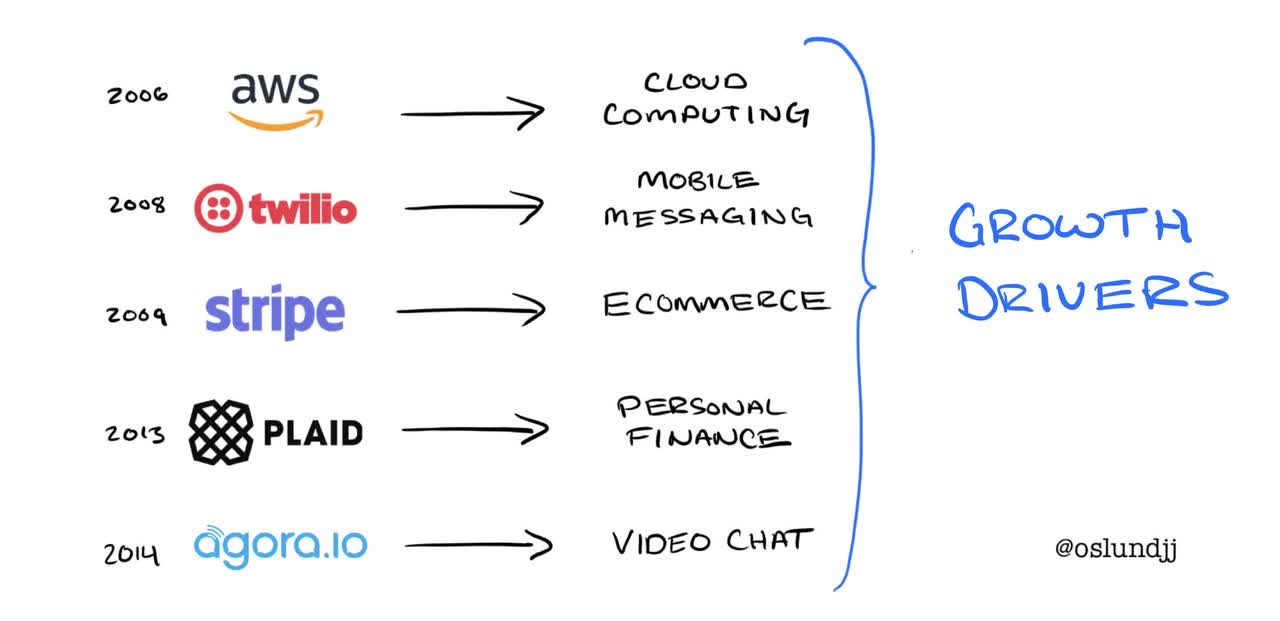

What's more, Agora is hugely scalable. The focus for Agora is on app developers. Again, even though Zoom is hugely successful, Agora is not attempting to compete with Zoom. Agora's closest competitor is arguably Twilio (TWLO), the messaging platform.

As an aside, its worth noting that Twilio's shareholders are incredibly passionate about Twilio its impressive dollar-based net expansion rate of 132%.

And although Twilio's is strong, Agora's clocked up 183% dollar-based net expansion rate in Q2 2020.

To repeat, Zoom is focused on masses and not classes. As the demand increasingly fragments, Zoom will not be able to cater to every need. Accordingly, the focus on Agora is on app developers more than consumers.

Developers can use Agora as a low-cost real-time video engagement platform that

Strong Investment Potential

Investing is about growing savings and avoiding risky investments. My Marketplace highlights a strong selection of hugely undervalued investment opportunities.

Stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

Investing Made Very EASY

I do the hard work of finding a select group of stocks that grow your savings.

- Honest and reliable service.

- Hand-holding service provided.

- Very simply explained stock picks. Helping you get the most out of investing.

- Helpful advice together with videos.