The management team at Liberty Oilfield Services (NYSE:LBRT) just struck a big deal with Schlumberger (NYSE:SLB) that should permit it to add significant value to its shareholders moving forward. This maneuver involves a merger of sorts that results in Schlumberger owning a sizable minority of what should be considered the new Liberty Oilfield Services. Due to the pressure facing the fracking industry, investors should consider that the future may not look as bright as the past has been, but the data provided makes the deal appealing no matter how you stack it. At the end of the day, it looks like Liberty will walk away with the lion's share of value. This should prove incredibly bullish for the business, even after taking into consideration the fact that units of the firm surged 35.7% in response to the development.

A look at the transaction

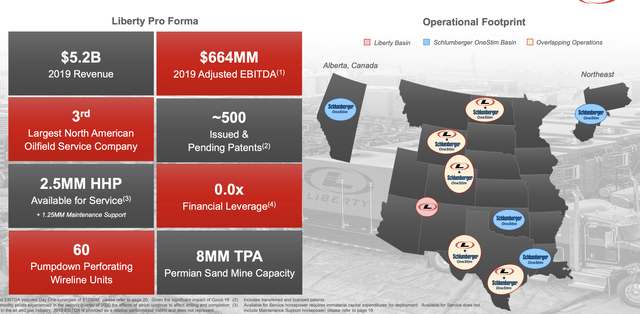

The transaction between Liberty and Schlumberger is fairly straightforward. Schlumberger is creating a new entity, transferring its OneStim assets into that entity, and transferring ownership of said entity to Liberty. In exchange Liberty is issuing to Schlumberger 66.3 million of its Class A shares. This works out to a 37% interest in Liberty that Schlumberger will end up having. Immediately upon completion of the transaction, which management believes will occur in the fourth quarter this year, Liberty believes that it can achieve around $125 million worth of synergies. This is quite odd since synergies generally take months, if not years, to achieve, but management said the rapidity of these synergies will be chalked up to the absence of corporate overhead expenses that the assets currently involve that won't be coming over with them from Schlumberger. Other incremental synergies that management predicted would be "significant" can be realized in the future as well.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!