The Makings of a Solid Contrarian Investment

Tecnoglass, Inc. (NYSE:TGLS) is a high growth glass and window manufacturer that is based in Colombia. While the company's stock used to have a 6% dividend yield to attract investors, this limited the company's ability to follow high growth, and they reduced it to 2% in March 2020. Many high-yield investors determined this to be a negative factor to shareholders, however, I agree with the management that long-term and sustainable expansion are far more important. Further, with the current growth expectations, I forecast that the stock price will grow by over 150% within five years, far out-pacing what would be expected with a 6% yield and reduced growth.

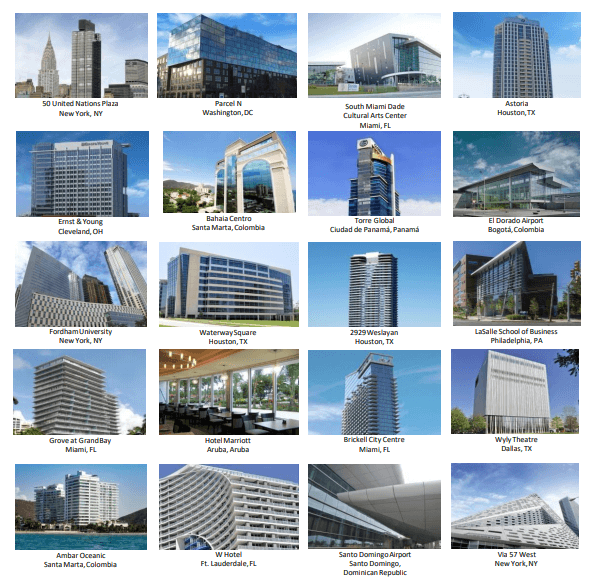

Image 1: Selection of new applications of Tecnoglass window technology, showing a wide diversity of both product and localities. This exhibits potent growth factors for the company long-term.

Colombia Macroeconomic Summary and Outlook

Do not let the location fool you. The past 20 years have been a success story for the country, with conservative fiscal policies and the establishment of peace leading to a positive financial environment. However, the major economic driver in Colombia is the production of oil and other primary materials, and current COVID-19 financial burdens and increasing renewable energy growth worldwide have created a poor outlook for the country. Therefore, Colombia may look to develop other industries to provide sustainable new growth industries to provide for future growth. This is supported by the fact that, "Colombia has a track record of prudent macroeconomic and fiscal management, and despite economic downturns has maintained its investment grade rating since 2013," according to the World Bank. Additionally, Colombia is ranked 4th overall in the Americas based on the 2020 Index of Economic freedom, behind Canada, Chile, and the United States, respectively. Against the world, Colombia is ranked 45th, finding itself