DocuSign's (NASDAQ:DOCU) stock was crushed more 10% on Friday after the company reported spectacular earnings the day before. As of the time of this writing, DocuSign is down by 25% from its highs of the year reached only 3 days ago, so volatility has been truly breathtaking in the stock.

This is happening in the context of a broad market selloff which is particularly hurting growth stocks, so investors are naturally wondering if the recent pullback is creating a buying opportunity in DocuSign or if the bullish thesis in DocuSign is now broken.

Make no mistake, the fundamentals remain intact and the bullish thesis is stronger than ever. The lower the price goes in the short term, the bigger the opportunity for long-term investors in DocuSign

The Fundamentals Remain Intact

DocuSign delivered a blowout quarter across the board: sales, earnings, and guidance exceeded expectations. The company is doing a great job of expanding into the additional areas beyond digital signatures, and management is increasingly betting on international markets for further growth.

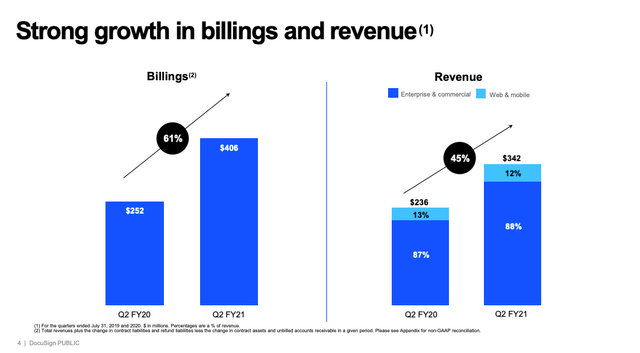

Billings grew 61% year over year to $406 million during the quarter, while revenue increased 45% to $342 million. The company added more than 88,000 new customers during the period. In fact, DocuSign acquired more new customers in the first half of this year than in all of last year.

Source: DocuSign

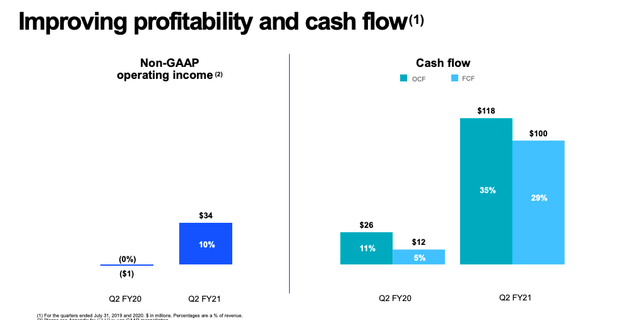

The company is making solid progress in terms of profitability too. Adjusted operating income reached 10% of revenue last quarter, and both operating cash flow and free cash flows reached record levels during the period. Rapid revenue growth in combination with expanding profit margins could provide a double boost to earnings growth in the years ahead.

Source: DocuSign

The company is being benefitted by the trend toward document management digitalization during the pandemic. But this is not a

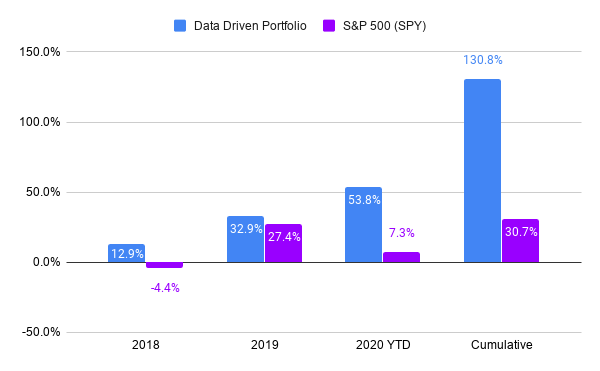

A subscription to The Data Driven Investor provides you with solid strategies to analyze the market environment, control portfolio risk, and select the best stocks and ETFs based on hard data. Our portfolios have outperformed the market by a considerable margin over time, and The Data Driven Investor has an average rating of 4.9 stars out of 5. Click here to get your free trial now, you have nothing to lose and a lot to win!